Shareholder returns come from three sources over the medium-term: growth in earnings per share (EPS), dividend reinvestment and multiple re-rating. The Global Equity Income Strategy relies on all three sources to drive returns. We are always looking for essentially sound companies which are trading at low valuations and pay an attractive dividend yield while we wait for the value to be realised

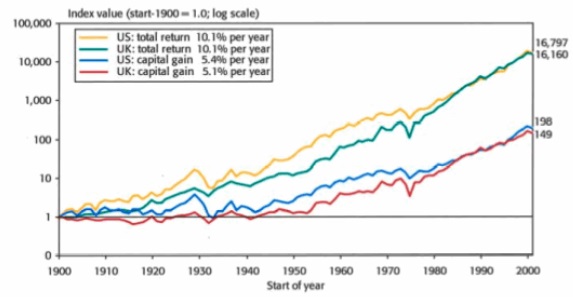

It is well established that the compounding effect of dividend reinvestment is critical to building long-term wealth. Over the last 100 years, total returns have been 10% per annum compared to capital returns of just 5% per annum. £100 invested in the UK market at the end of 1899 would be worth £14,463 without the reinvestment of dividend income but £1,509,148 if income was reinvested (both in nominal terms).

Source: Elroy Dimson, Paul Marsh and Mike Staunton, Triumph of the Optimists, Princeton University Press, 2002

However, what is often underestimated is the power of dividend reinvestment when made at low valuations. This can translate into even higher returns if any re-rating occurs. Counterintuitively, a fall in the share price can drive even greater returns over the long run.

Warren Buffett talks about this point from the perspective of repurchasing shares in his 2011 annual letter to Berkshire Hathaway shareholders. Share repurchases are economically equivalent to a dividend reinvestment:

"When Berkshire buys stock in a company that is repurchasing shares, we hope for two events: First, we have the normal hope that earnings of the business will increase at a good clip for a long time to come; and second, we also hope that the stock underperforms in the market for a long time as well….The logic is simple: If you are going to be a net buyer of stocks in the future, either directly with your own money [through reinvested dividends], or indirectly (through your ownership of a company that is repurchasing shares), you are hurt when stocks rise. You benefit when stocks swoon. Emotions, however, too often complicate the matter: Most people, including those who will be net buyers in the future, take comfort in seeing stock prices advance.”

Many companies, especially those now considered ‘bond proxies’ (equities such as consumer staples and utilities with safe, predictable returns, but have higher yields than much of the bond market), were able to deliver attractive returns when earnings grew slowly, valuations were reasonable and large dividends were paid alongside the repurchase of shares to drive EPS growth. These attractive returns then turned into exceptional returns when the companies re-rated as interest rates fell.

An example of this is WD-40. WD-40 specializes in multipurpose maintenance products, home-care and cleaning products. It is best known for its ‘signature blue and yellow can’1 used to fix squeaks, lubricate and prevent rust and corrosion. A previous CEO claimed that four out of five households in the USA had at least one can of WD-402. WD-40 has a strong competitive position that has consistently generated good returns on capital.

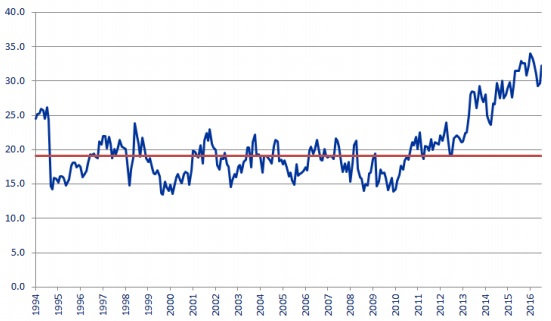

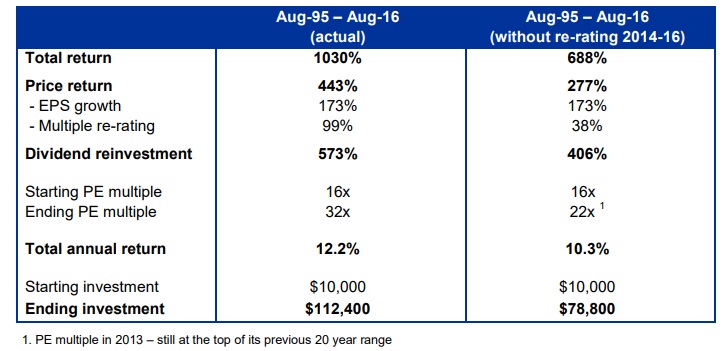

A $10,000 investment made in WD-40 in 1995 would have risen to over $110,000 by 2016. This equates to a total return of just over 1000% – an impressive annual growth rate of 12% over 21 years. However, when we disaggregate this return we see that it has benefitted greatly from the price-earnings (PE) multiple increasing to 32x at the end of FY2016. This is clearly well above its historic range and its 20 year median average of 19x.

WD-40 PE Chart

Source: Bloomberg

Unless WD-40 is about to grow its earnings significantly (net income has grown at 5% per annum over the last 20 years and it seems unlikely that there will be a mad rush for more cans of WD-40), people are simply paying more for the same earnings profile.

The impact of the PE multiple increasing is seen within the total return in two places:

- The price return given the higher share price.

- The impact on dividend reinvestment (particularly in cases where high dividend yields have been reinvested into more shares when prices and valuations were low).

The table below provides a breakdown of the total return for WD-40. To highlight the impact of the re-rating that occurred over the last three years we constructed a scenario whereby the PE multiple remained constant at 22x from 2013 onwards (the right hand column). Had this happened, the total return would have still been a very attractive 10.3% per annum. The $10,000 investment would have risen to a healthy $79,000 by the end of 2016 – but that’s still over $33,000 less!

As discussed above, high dividend yields and attractive valuations create a great compounding effect from the dividend reinvestment aspect. In the case of WD-40, the reinvestment effect meant that ownership more than doubled since an original purchase in 1995.

This was achieved because, during the early part of the investment, the dividend yield was good and reinvestment took place at attractive valuations. During the first 8 years, WD-40 had a dividend yield of 4%+ and was trading on a PE multiple of 15-20x. Investors were increasing their holding by approximately 5% per year.

What happens now?

We expect business-as-usual for WD-40 from a fundamental operating perspective. However, prospective returns from this point are likely to be worse than its historic return profile. This is due to its starting valuation and, with a dividend yield of just 1.4%, the power of dividend reinvestment and compounding through the ability to ‘own’ more shares by buying at favourable valuations is greatly diminished.

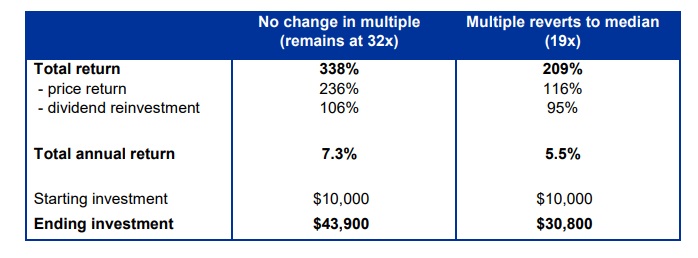

If one assumes that the business operations over the next 21 years are much like the last (which we think is reasonable), then returns are going to be much lower without a further re-rating. This assumes:

- EPS growth of 5%

- A steady dividend payout ratio

- A similar profile of capital usage (share buyback, etc.)

If there is no change in the multiple (remains at 32x), the total annual return will be around 7%. If the multiple reverts to the long-term median of 19x, the total annual return will be around 5.5%.

In order to generate the same 12% total return per annum over the next 21 years the PE multiple would need to re-rate to an astonishing 90x!

The Global Equity Income Strategy

We are always looking for essentially sound companies which are trading at low valuations and pay an attractive dividend yield while we wait for the value to be realised. This combination can lead to a greatly improved compounding effect from the dividend reinvestment aspect.

Our most recent addition to the portfolio is Britvic, the soft drinks supplier. The company has a dividend yield of 4.2% and is trading on a PE multiple of 12x, compared to its long-term average of 17-18x. The outlook for the industry remains favourable and EPS has grown at around 7% per annum since listing. It reminds us in many ways of WD-40. But we will write more about this and our investment rationale in our February newsletter.