In April, after thirty years on the Chrysanthemum Throne, Emperor Akihito will abdicate and the Heisei Imperial reign will come to an end.

Although the role of the Japanese emperor, like that of the British monarch, is now largely ceremonial, it is worth looking back at what has happened in Japan during his reign and look forward to what we might begin to expect during that of his son, Crown Prince Naruhito, the name of whose reign will be announced by Prime Minister Abe on 1st April.

Emperor Akihito. Source: Wikipedia

Emperor Akihito. Source: Wikipedia

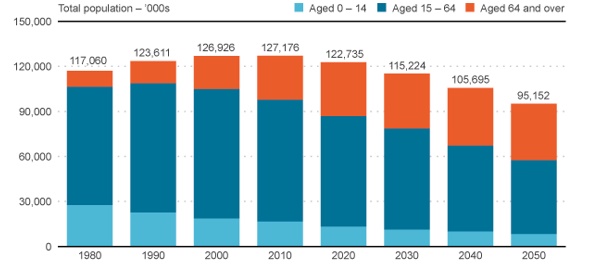

What has become clear in recent years and is symbolised by the forthcoming abdication of the Heisei emperor due to his own concerns about his advancing years and deteriorating health affecting his ability to fulfil his role, is that Japan is a rapidly ageing society with a falling population and the challenges and opportunities that that presents. So, what has happened in those thirty years?

There have been two major earthquakes (Kobe in 1995 and Tohoku in 2011) with significant destruction of property and loss of life on an enormous scale. These tragedies led to an improvement in building standards, the renewal of large areas of major cities where demand for property remains strong and the replacement of outdated infrastructure, especially that of the nuclear power sector which was deeply affected by the tragedy of the Tohoku tsunami and the consequent nuclear accident at the Fukushima Daiichi reactor.

The 1980s real estate bubble burst in the early 1990s and property prices, with one or two notable exceptions, still remain significantly below peak levels, particularly in the regions. The Nikkei index peaked at close to 39,000 in December,1989; since when the closest it has got to that level was just shy of 25,000 in October, 2018. The collapse of real estate and equity prices resulted in the failure of a number of financial institutions and a government rescue of the banking sector which culminated in the number of so-called ‘City Banks’ falling from 20 to three and arguably led to a long period of deflation. That amalgamation of the major financial institutions, a previously unthinkable situation, caused the restructuring of other industries leading to, for example, the formerly independent Sumitomo and Mitsui keiretsu groups merging and their respective associated industries also combining.

The opening up of former communist economies in the early part of the Heisei reign, including the rise of China as a world-leading economy to challenge Japan and the United States, presented opportunities for companies to broaden their global reach as cheap pools of labour and new consumer markets emerged. For Japan, however, it came as a threat to its dominant position in a number of industries which required streamlining and plant closures on an unprecedented scale. Eventually the Japanese Fair Trade Commission recognised that in areas such as steel Japan was no longer competitive, due to overcapacity domestically and on a global stage. In the light of that, the FTC acceded to a merger between, for example, Nippon Steel and Sumitomo Metal Industries as the only way for Japan to compete internationally, even though it technically broke the monopoly rules in its home market. Other examples have followed in sectors such as paper and autos.

Falling demand at home, due primarily to the ageing population and the bursting of the 1980s bubble, resulted in entrenched deflation, which was only tackled seriously by the Bank of Japan with monetary expansion on an unprecedented scale and eventually negative interest rates after the arrival of a new government under Prime Minster Abe in 2012. In spite of those moves, however, inflation remains obstinately stuck below the BOJ’s two per cent target level, albeit that it is now in positive territory.

Almost twenty years ago Nissan Motor was rescued from bankruptcy by Renault, a subject that continues to influence decision-makers right up to this day with the current charges levelled at Carlos Ghosn and the continuing discussions about a possible merger between Renault, Nissan and Mitsubishi Motors. Under the leadership of Mr Ghosn many of Nissan’s associated subsidiaries, which had supplied the automaker with parts at uncompetitive prices were shed and outside suppliers brought in: a response by Mr Ghosn to Nissan’s loss of global competitiveness that has since been mirrored by many other companies.

With the election of Shinzo Abe, new regulations were introduced to facilitate longer term change in areas that were holding back growth: low immigration, a falling birth rate, an ageing population, outdated corporate governance structures, fiscal policies that did not enable a changing work force and an entrenched bureaucracy which mainly supported large companies and how they had traditionally done business. Although Mr Abe has been given credit for recent changes, particularly in corporate governance and the opening up of Japan to foreign workers, they were set in train more by economic necessity than political expediency and had been flagged at least as early as under the government of Junichiro Koizumi in the early 2000s.

Japan's ageing population

Note: 2010 to 2050 figures are estimates. Sources: Statistics Bureau of the Ministry of Internal Affairs and Communications, IPSS. Chart source: Reuters.

It is noticeable how much more open Japan is to foreign influence than just a few years ago. This is visible through the entry of large numbers of inbound tourists (targeting 30 million by 2020, ten million more than the original target set in 2014 by Mr Abe for that date) and the lifting of visa restrictions on foreign workers to allow for the off-setting of labour shortages in certain industries (construction, care industry, retail, etc.) which was promulgated last year.

Corporate Japan appears to be changing. Stricter corporate governance regulations and the introduction of a Stewardship Code have undoubtedly played their part in improved board structures, higher shareholder returns and a move towards improved balance sheet efficiency. The question, however, is to what extent are these moves the result of cyclical improvement

due to higher global growth in the past ten years as profits have risen and competition intensified? Or are they longer lasting positive secular changes as companies respond to increasingly strict regulations and as they recognise the need to eradicate inefficient legacy businesses and unrewarding relationships?

The New Emperor’s Clothes or The Emperor’s New Clothes?

In 1837 Danish author Hans Christian Andersen wrote a story of two weavers who promised to make an emperor an expensive new suit of clothes that they said was invisible to those unfit for their positions, too stupid or incompetent to fulfil their posts. The story went that when the emperor paraded in front of his people in his new ‘clothes’, which of course did not actually exist, no one dared to say that they could not see them for fear that they would make themselves look stupid: it took an innocent child to disclose the fraud by saying that the emperor was not wearing anything at all.

Illustration by Vilhelm Pedersen. Source: Wikipedia

Illustration by Vilhelm Pedersen. Source: Wikipedia

The question about corporate change in Japan is really, therefore, fact or fiction?

Our conclusion is that in most cases there is a real suit of clothes and that the new Emperor’s reign will mark a continuation of the reforms that have been taking place at an increasing pace over the last few years and that much of it is driven by demographics and change brought on once again by the financial sector.

Driven by the financial sector and political need

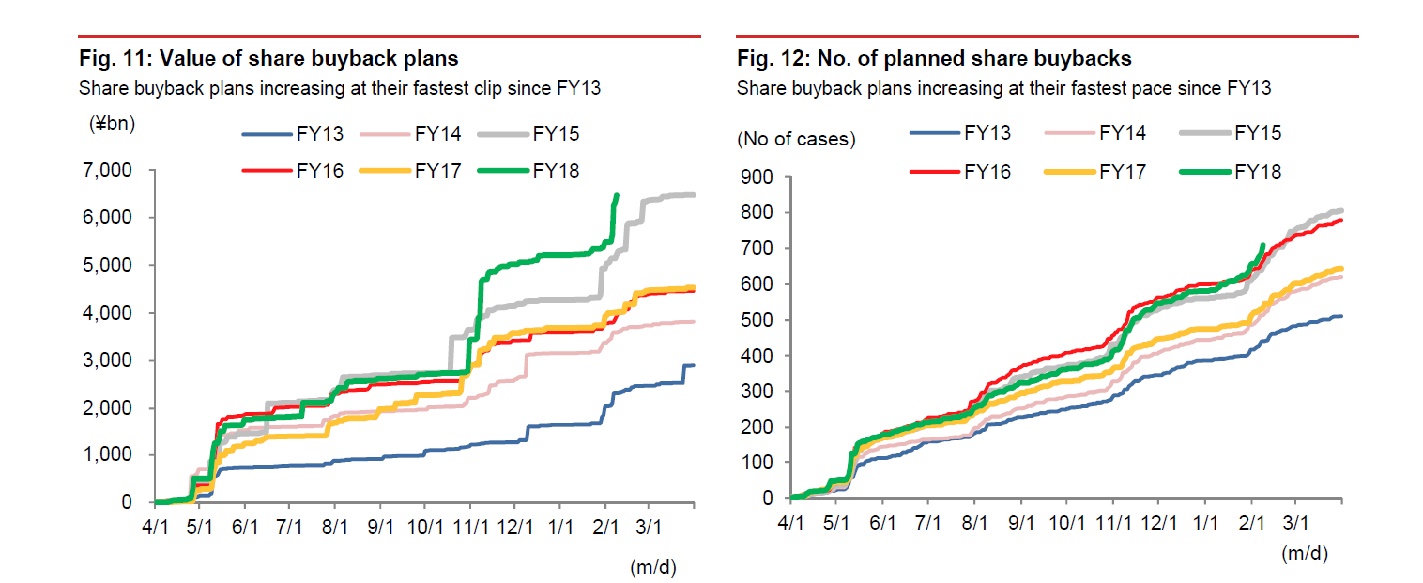

A rapidly ageing society requires improved shareholder returns to help improve pension fund returns and that trend towards better returns is happening under recent corporate governance reforms. Both the value of share buyback plans and the number of share buybacks are rising at the fastest pace since FY 2013.

Share buybacks (Nomura):

Note: Data as of 8th February 2019. Source: Nomura, based on company data.

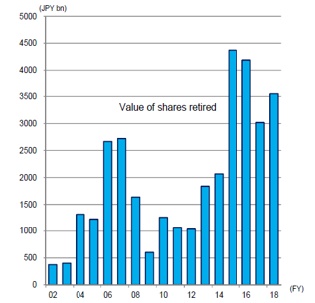

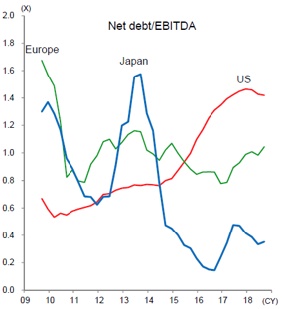

In the past, Japanese companies were criticised for not retiring their shares after they had been repurchased. In the mid-2000s, annual repurchases by all listed companies exceeded Y4tn, but the amount retired was only about Y2.7tn, as share buybacks were used as a method to absorb the unwinding of cross-shareholdings by financial institutions. Recently, the main purpose of share buybacks has been to boost shareholder returns, with recent estimates in the Nikkei newspaper indicating more than Y5tn of stock is poised to be retired for the fiscal year ending March 2019. Japanese companies tend to increase share buybacks when share prices decline, driven by their solid balance sheets. The ratio of net debt to EBITDA of Topix 500 constituents (ex-financials) that have repurchased shares has fallen since 2014 to 0.42x, as shown in the charts below.

Figure 1: Value of shares retired by year

Note: Common shares of all listed companies; estimated from the number of shares retired and closing prices on day shares are retired; FY2018 figure as of 8th February. Source: MUMSS, from I-N Information Systems data.

Figure 2: Financial health of companies implementing share buybacks (Japan, US, and Europe):

Note: S&P500 for the US, STOXX600 for Europe, and TOPIX500 for Japan (ex-financials); net debt to EBITDA ratios of companies implementing share buybacks calculated in each quarter; 4 quarterly MA. Source: MUMSS, from FactSet data.

More importantly, however, those reforms are being bolstered by improvements in balance sheet efficiency, in particular the buying in of listed subsidiaries or their disposal if not required for operational purposes. Also, cross-shareholding unwinding is taking place at an accelerating pace, particularly where the other party is a financial institution or trading house; there is currently less movement where the counterparty is a customer or supplier, the relationship with whom may be negatively influenced by the sale of their shares.

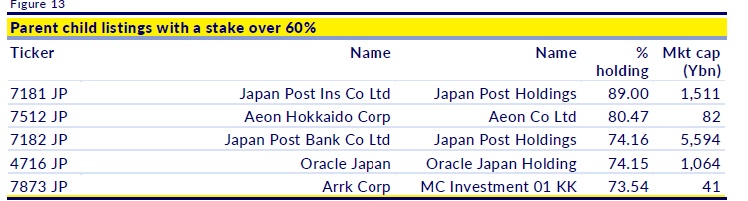

Table of Parent child listings with a stake of over 60%:

Source: CLSA, Bloomberg.

One important factor which should improve governance further is the proposed introduction, over the next three years, of a new Tokyo Stock Exchange Index. The suggestion is that the minimum market capitalisation threshold will be raised from Y2bn to Y25bn; that there will be higher governance standards for inclusion including improved board structures and the unwinding of listed subsidiaries unless true independence from the parent can be demonstrated; and certain performance metrics are met, such as disclosure of quarterly earnings announcements in English. Changes brought on by such an index would be likely to influence a number of stocks including Japan Post Holdings with its majority-owned, but independently-listed Japan Post Bank and Japan Post Insurance with a price to book value of 0.5 and 0.7 respectively. Toyota Motor is also an example of where change could be significant with its 124 subsidiaries, several of which are large, listed companies in their own right.

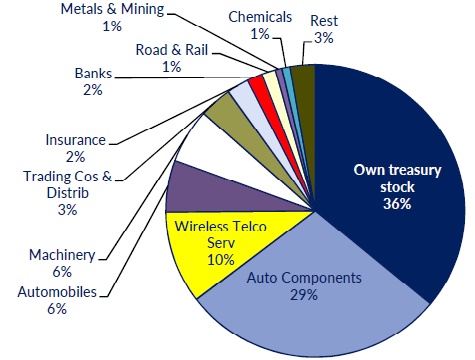

Toyota’s equity holdings:

Source: CLSA, Bloomberg.

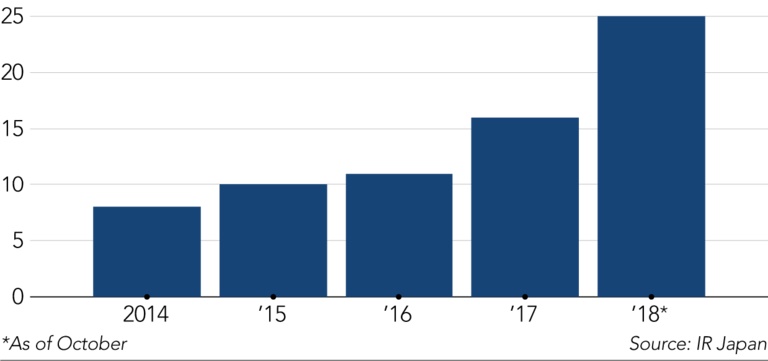

In addition to regulatory change is the role of activist investors, who are largely targeting companies with substantial unused net cash piles or significant equity holdings. Recently, the number of activist Japan funds has increased dramatically (see chart) and in the past year, the number of companies targeted by this type of investor has risen from 20 in 2016 to 45 in 2018. We expect that number to increase steadily, encouraging companies to buy back shares and reward shareholders in other ways.

Number of activist funds in Japan:

The reason that these changes are being pushed by the banks and other financial institutions is probably due to the lack of profitability of the domestic banking sector, largely as a consequence of the Bank of Japan’s negative interest rate policy and most recent ten-year JGB zero rate targeting. Added to which the lack of reform in the domestic regional bank market and the overbanking of that sector has kept pressure on margins, even as economic growth has improved.

Interestingly, a recent series of articles about the Fair Trade Commission finally allowing regional bank mergers, albeit ‘short term’, may well mean that the reforms proposed by Heizo Takenaka, a minister in the Koizumi cabinet responsible for, inter alia, the privatisation of the post office, in which the 47 prefectures of Japan no longer had to have at least two banks each to foster competition, but should merge to produce, say, nine super prefectures with competing banking systems, may actually come about and bring with it much needed reform and higher profit margins.

Emperor Akihito and Empress Michiko. Source: The Independent.

Emperor Akihito and Empress Michiko. Source: The Independent.