The process by which income is obtained is hotly contested by investors. Believing price is a crucial determinant of future returns, we remain firmly in the value camp.

The current low growth, low inflationary environment means that the search for a sustainable and growing income stream remains a vital part of the investor toolkit. Sometimes we need reminding just how vital. In extensive academic studies, Professor Elroy Dimson identifies income as the single, most powerful source of total return. He concludes that, over the very long run, dividend income accounts for almost two thirds of US equity returns1. That said, exactly how investors choose to receive their income is the subject of vigorous debate.

Some favour the dividends of the highly rated bond proxies, for example utilities and consumer staples, as their primary method of capturing yield. They choose to focus more on the solid and dependable earnings streams these companies produce, believing their consistency in a low-growth world is what really counts. Given, in our view, the lofty multiples on which some of these stocks sit, it appears these investors have scant regard for price tags.

Others, like ourselves, believe in the time-tested theory that starting valuations are one of the key drivers of expected return (the other two being dividend yield and earnings growth). With the value/growth ratio approaching levels last seen just prior to the bursting of the dotcom bubble2, we firmly believe that the value opportunity stands at extreme levels. And just because our value names – typically financials, industrials and, more generally, cyclicals – are overlooked at present, that does not mean they will remain so forever.

Investors would be unwise to dismiss these 'operationally sound' entities altogether. Often possessing specific qualities of their own, they may typically be the lowest cost operators in their respective fields (such as Rio Tinto). They may produce double-digit returns on capital (such as Philip Morris International) and/or a reasonable degree of pricing power feeding through to their bottom line (such as Allergan).

It may come as a surprise that several of our holdings typically reward investors with a larger income stream than that of the bond proxies… and at a far cheaper price. While other holdings pay only a small dividend, the degree of value embedded in these types of companies, such as IWG (formerly Regus) in the UK and Seritage Growth Properties in the US, we believe, makes them more than capable of producing attractive total returns over the long run.

Nevertheless, to even make it to the starting line, the companies we hold must jump over a fair few hurdles. From a universe of around 2,000 stocks, we will only include 20-30 in the portfolio at any one time based on fundamental, bottom-up research. As contrarian, unconstrained investors we do not follow benchmarks, so our sector and geographic weightings will look very different to those of our peers. Presently, we hold around 30% of the portfolio in the UK stock market, favouring domestic names such as Lloyds and Tesco. These are companies whose share prices have been affected by the noise and emotion of Brexit, despite their strong business models. By contrast, we have just 20% or thereabouts in the US where income streams currently come with a heftier price tag.

While no one knows when, or how, value will start to outperform growth, we believe there are already clear signs why value should return to favour once more. The number of IPOs that are loss making currently is the same as in the year 2000 – the height of the dotcom boom. Furthermore, the extreme levels of negative yielding debt leave us wondering if the bond market has not taken leave of its senses altogether.

As stock pickers continue to trawl the globe in search of rich income streams, we do not dispute that the methods by which they do so are many and varied. But as value investors, our preferred route is to find income from areas of the market where sentiment is poor. This does not mean that we seek out statistically cheap companies that are likely to remain just that. Our central tenet is to uncover temporarily unfashionable or unloved companies, which trade on attractive valuations relative to their long-term historic averages and are capable of producing a growing and sustainable income stream over time.

Over the last five years, interestingly, this income stream has grown at a similar rate to the higher dividend yielding index3, which is dominated by the bond proxies. So, as value managers, our simple question to those who sit in the bond proxy camp has to be this: if the yield on our holdings and the rate of dividend growth are similar to yours but the price we have paid is, in many instances, almost half, then why would you pay more? As Warren Buffett remarks so succinctly, 'Price is what you pay. Value is what you get.'

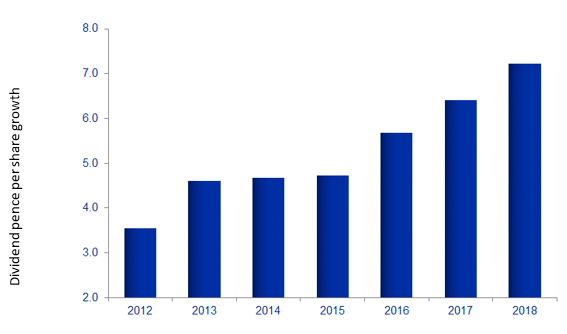

On the up: dividends from the strategy have doubled over six years (in GBP terms)

1. Source: Professor Elroy Dimson and the Brandes Institute. Data collected from 1926-2014.

2. Source: MSCI and Bloomberg. MSCI World Value Index vs MSCI World Growth Index (total return) as at 30 June 2019.

3. Source: The MSCI High Dividend Yield Index includes only those securities offering a higher than average and sustainable dividend yield relative to that of the parent index.

If you would like to know more about this strategy, please click here.