For fund investors, there has probably never been a more important time to truly know, understand and trust the fund managers looking after your money. The COVID-19 pandemic has created many uncertainties, so we look for a steadying constant: the people, institutions, or beliefs that we trust and rely on to be consistent through tough times.

Despite a recovery from the March lows, investing during the last three months has been a nerve-wracking and unsettling experience as global equity markets plunged at the near complete shutdown of the global economy. Even those with the strongest nerve will likely have been left feeling vulnerable and hesitant, asking themselves what should they do, where should they invest and with which fund managers?

For investors using the services of third-party managers, these are exceedingly challenging times. There have been 30% losses on funds where you would not expect it. So how do you react? We believe the best advice is not to panic – although we accept this isn’t easy. Look through your line-up of managers and assess what they have been doing during recent months. Have they performed as you expected? If not, why not? Have they been transparent in their communication and clear about the reasons? What changes have they made to their portfolio and do those changes seem reasonable given their philosophy and approach?

A forensic analysis in this way may reveal some surprises. Some managers do strange things under extreme pressure. A well-trodden philosophy or disciplined investment process can be twisted or abandoned altogether for the comfort of the crowd. You know why you hired a manager or bought a fund. You understood the role it was to play in your portfolio/s. At this time, you need to be reassured that they still fulfil this role.

At Oldfield Partners, we are Value managers and, along with others that follow this tried and tested investment philosophy, we have had a tough few years of performance. Value and its associated stocks have had a difficult time – selling off more in the March collapse and lagging in the subsequent bounce. However, that does not mean the approach is broken: we still believe that, over time, Value will out, it simply requires patience. It is extremely difficult in very fast-moving markets to consistently get “big decisions” and forecasts right.

As fundamental stock pickers building a diversified portfolio, we want to be making lots of smaller decisions on stocks and consistently get the majority right. As patient, contrarian Value investors, we try not to get overly excited when things go well and not to get too dispirited about things going badly. Valuation discipline helps regulate our emotions. Hyperactivity and taking action for the sake of it can be the enemy. That is not to say “do nothing”, but move slowly and thoughtfully, and don’t let past performance, whether by a stock or a manager, overly influence your judgement. The environment of the past three months may not necessarily be repeated in the next three months. Market leadership changes. It is critical to have balance in a portfolio and not to be too heavily skewed in one direction.

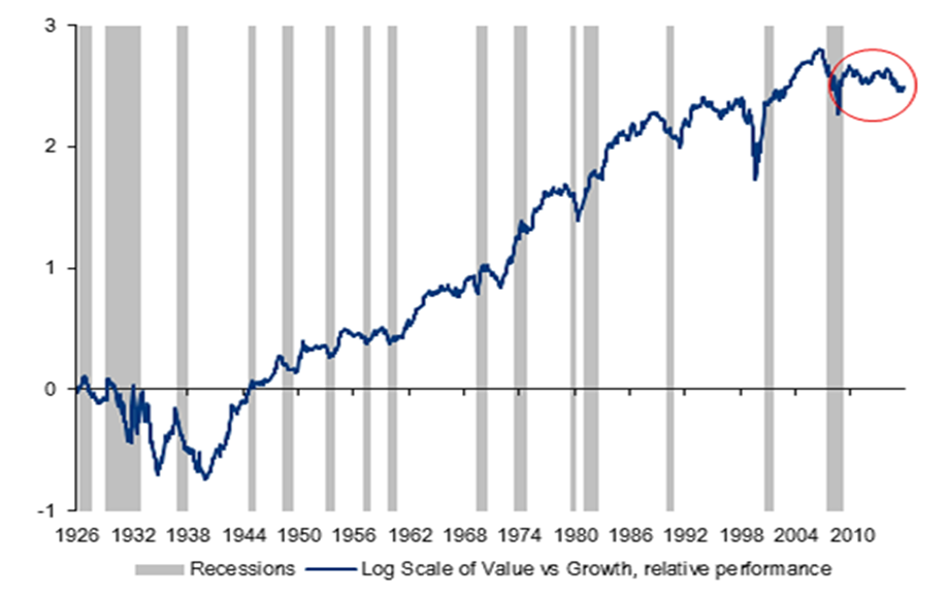

Oldfield Partners is firmly committed to Value investing. This is not some whimsical affectation; it comes from a firm conviction that over time investing in companies with low valuations tends to produce good returns. “Tends” is a caveat; there are periods when it does not, and the recent few years has been one of them. We believe that those of you who have contrarian Value exposure should stay committed too – Value investing is empirically proven to work* (see chart below).

US Value versus Growth, relative performance (log values)

Source: BofA Global Investment Strategy, Ibbotson, Fama-French

Source: BofA Global Investment Strategy, Ibbotson, Fama-French

If you invest with a Value manager, you need to be confident that they will stick with it at this difficult time. As the pressure to conform to the herd grows, a Value manager must remain steadfast and disciplined. To judge them, analyse their recent actions and activity. It should be clear that they have re-evaluated all of their holdings – the overall investment thesis, business fundamentals, balance sheets and operational risks – in this extraordinary environment. They should have stress-tested those stocks most gravely impacted by COVID-19. That may mean some positions have been sold – look for clear and honest assessment from the manager about those decisions.

In addition, review what they have been buying. Inertia would be a worrying sign. Expect purchases of stocks which give you discomfort, arising mainly from uncertainty about their future. Making predictions about the immediate future, while suspect at the best of times, is almost ridiculous at the moment, but there are three things that we can be sure of. First, revenues for most companies will be sharply impacted for a while; second, governments will ‘do whatever it takes’ to protect their economies; third, there will be a recovery, it is just a question of degree. A company suffering in an industry that has been very negatively impacted by the pandemic may still be a good investment if it is able to survive for a year with no revenue whilst competitors go under, thus emerging in a stronger position in a recovered industry in a few years’ time.

While we should all be confident that there is a route out of this crisis, we may face more market turbulence in the near term. You can use this as an opportunity to rebalance, either towards asset classes, particular exposures, or managers. Rebalancing towards Value at this point makes sense given the extreme difference in valuations and performance between Growth and Value, providing you have conviction that you or your manager will stay true to the style.

*Ibbotsen Associates, an investment consulting firm, found in a recent study that, since 1927, “Value’ (focussing on the portion of markets consisting of companies with low valuations in terms of price-earnings, price - sales, price-book and price-cash flow, and dividend yields)has outperformed growth in 84% of all the 10-year periods.