At Oldfield Partners, we have a philosophical commitment to contrarian Value investing. This requires both patience and the right investment culture. We believe that those who can take a long-term view and disregard index composition are at an advantage – they will be less a slave to momentum and buy shares when they are out of favour and a bargain. Moreover, we believe that modern markets are rife with short-termism. Share prices tend to overreact after adversity, providing investable opportunities.

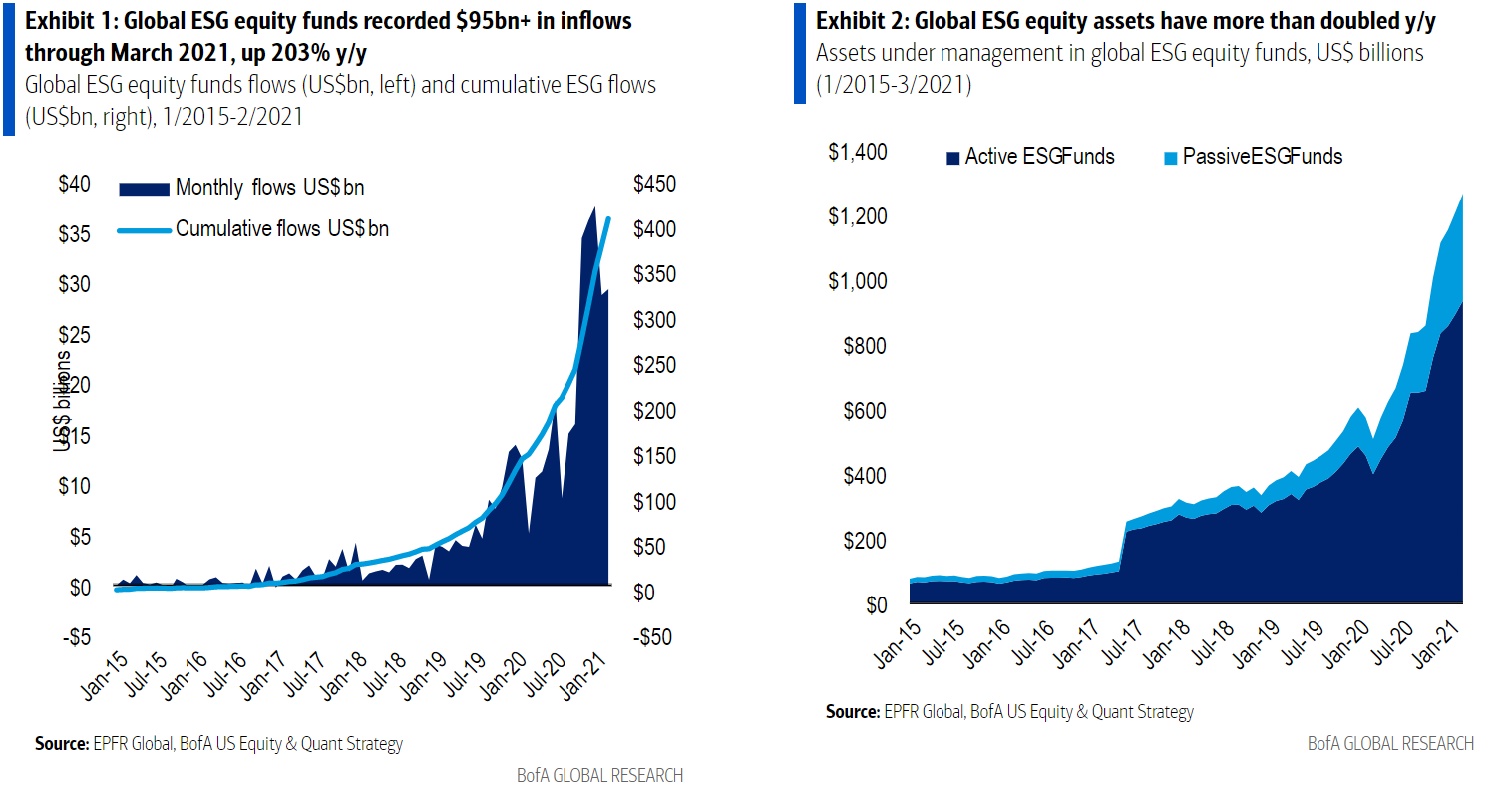

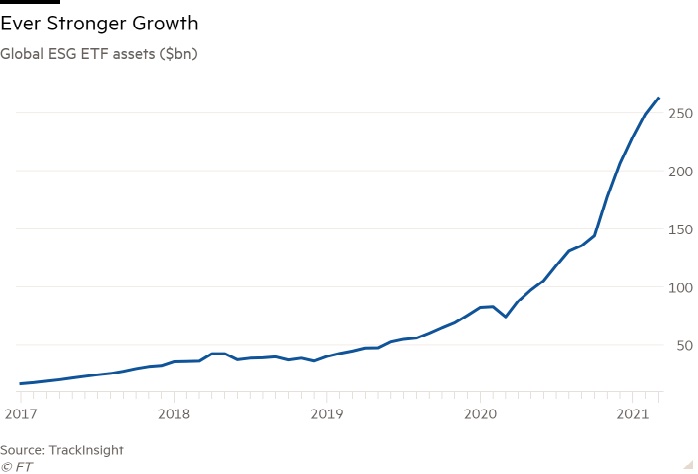

This usually means going against the tide of market opinion – including if this is driven by ESG factors. The stratospheric growth in ESG-led strategies has driven a flight of capital from those companies perceived as having ‘poor’ ESG credentials into those with perceived ‘good’ ESG credentials. In our opinion, this has created an interesting new hunting ground for out of favour bargains.

However, to avoid Value traps and for the investment case to deliver, we need to see a path to the valuation recovering to the level we view as fair given its growth and returns on capital. This means that, where ESG issues are a material driver of cheap valuations and poor sentiment, we need to see a path to these issues improving. In keeping with our contrarian Value philosophy, patience is required. We are genuinely motivated to engage with companies to deliver an improving trend. And where we see a credible strategy being formed, we are willing to give management time to implement this change.

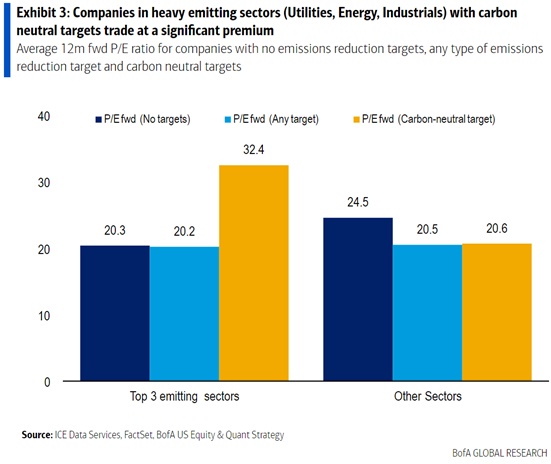

As an example, certain companies with heavier carbon dioxide-equivalent emissions have suffered a greater degree of capital flight as many investors have chosen to be associated with only those companies that face lower risk from the energy transition required for the world to reach the net zero goal by 2050. As a result, fossil fuel producers and others with large emissions measured from Scope 1 to 3 have suffered from large falls in valuation and sentiment terms. This makes for an interesting starting point in our view.

But for the investment case to work, and valuation to improve, these companies need to demonstrate a credible action plan to adapt to a decarbonising world, and to be able to show that they can deliver attractive financial returns in spite of the energy transition. We are therefore compelled to engage with these management teams on their decarbonisation strategies. We are members of the Climate Action 100+, the Institutional Investors Group on Climate Change and we are supporters of the Task Force on Climate-related Financial Disclosures (TCFD). We will engage with the companies in which we invest if a company has yet to commit to net zero emissions by 2050 or appears to be slipping in their roadmap to achieve that goal. For example, we are shareholders in Korea Electric Power, one of the ‘dirtiest’ carbon emitters in the world. We believe that the transition away from coal-fired generation towards a greater mix of renewables and nuclear is a meaningful driver of de-risking the investment thesis. In collaboration with our Climate Action 100+ co-investors, we have been engaging with senior management to accelerate the company’s transition away from coal-fired generation, and commit to achieving net-zero emissions by 2050.

While it is true that the recent flood in ESG-led investing has created new opportunities to identify ESG ‘reformers’, the fundamental analysis of ESG issues is an already established

part our investment process. We have had the long-standing view that ESG-related issues can provide investment opportunities where we can see an improvement in such issues playing a role in the recovery in the results and perceptions of a company and its share price. We embed responsible investment in everything we do. We consider it an important part of company analysis to assess corporate governance, as well as the management of social and environmental issues. This forms part of our risk assessment of business fundamentals. We believe that ignoring ESG factors may lead to an incomplete understanding of the risks to an investment case, and may consequently result in the wrong investment decisions.

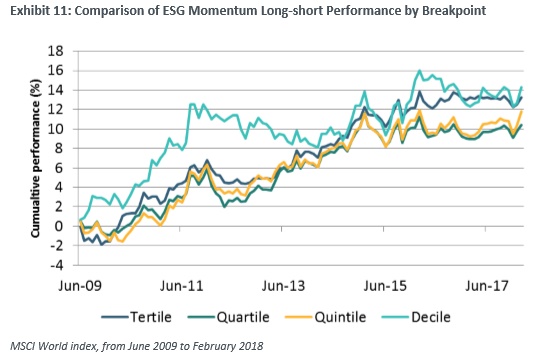

There is evidence to support our approach. We have written in the past about MSCI’s research on ‘ESG momentum’ (their terminology for ESG rating changes). This research concluded that MSCI ESG score upgrades led to higher valuations, and downgrades to lower valuations, all other parameters being equal. Moreover, the results suggested that financial markets have historically not been agnostic with respect to companies’ ESG profile when pricing securities – a change in a company’s ESG profile has had an impact on valuation and stock prices that is not explained by the general market or other factors.

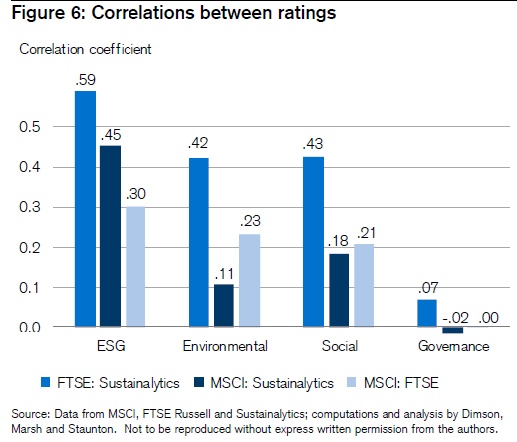

At this point it is worth reiterating our strong belief that ESG analysis requires careful bottom-up fundamental analysis. We have already written about the danger of relying on external ratings as a substitute for proprietary ESG research. The rating system itself is only as good as the underlying data available. In many cases, ratings are calculated based on available data alone, with missing data simply being ignored. Even if a company’s disclosure is up to scratch, there are still complications depending on ESG ratings. This is because of the way rating agencies weight different factors in their scoring systems can vary drastically.

We are strongly aware of not taking ESG ratings at face value. We do not create elaborate scoring systems which mean a company can do well in one area and poorly in another, but the overall score is still ‘good’. Instead, ESG rating reports are just one input in our own assessment of the material risks to an investment case – our own conclusions can differ materially.

To summarise, we are Value investors through-and-through. We are drawn to where there is poor sentiment and low valuations, including if this is being driven by ESG factors. But we are also in the business of avoiding Value traps, which means identifying a credible path of improvement. This is true whether ESG issues are a material driver of cheap valuations and poor sentiment, or not. This explains our earlier statement that we are genuinely motivated to effect change through engagement. And where we see a credible strategy being formed, we are willing to be patient. The explosion of ESG-led investing has provided us with new hunting grounds. As experienced contrarian investors, with patience and deep analytical skills, we have a competitive advantage in uncovering the real ESG ‘reformer’ bargains.