Recent headlines in the financial press have been dominated by the yield of 10-year US Treasury bonds hitting a multi-year high of 4.7%. Using Bloomberg data, such yields were last seen in 2006 and 2007, just before the outbreak of the Great Financial Crisis.

Source: Bloomberg

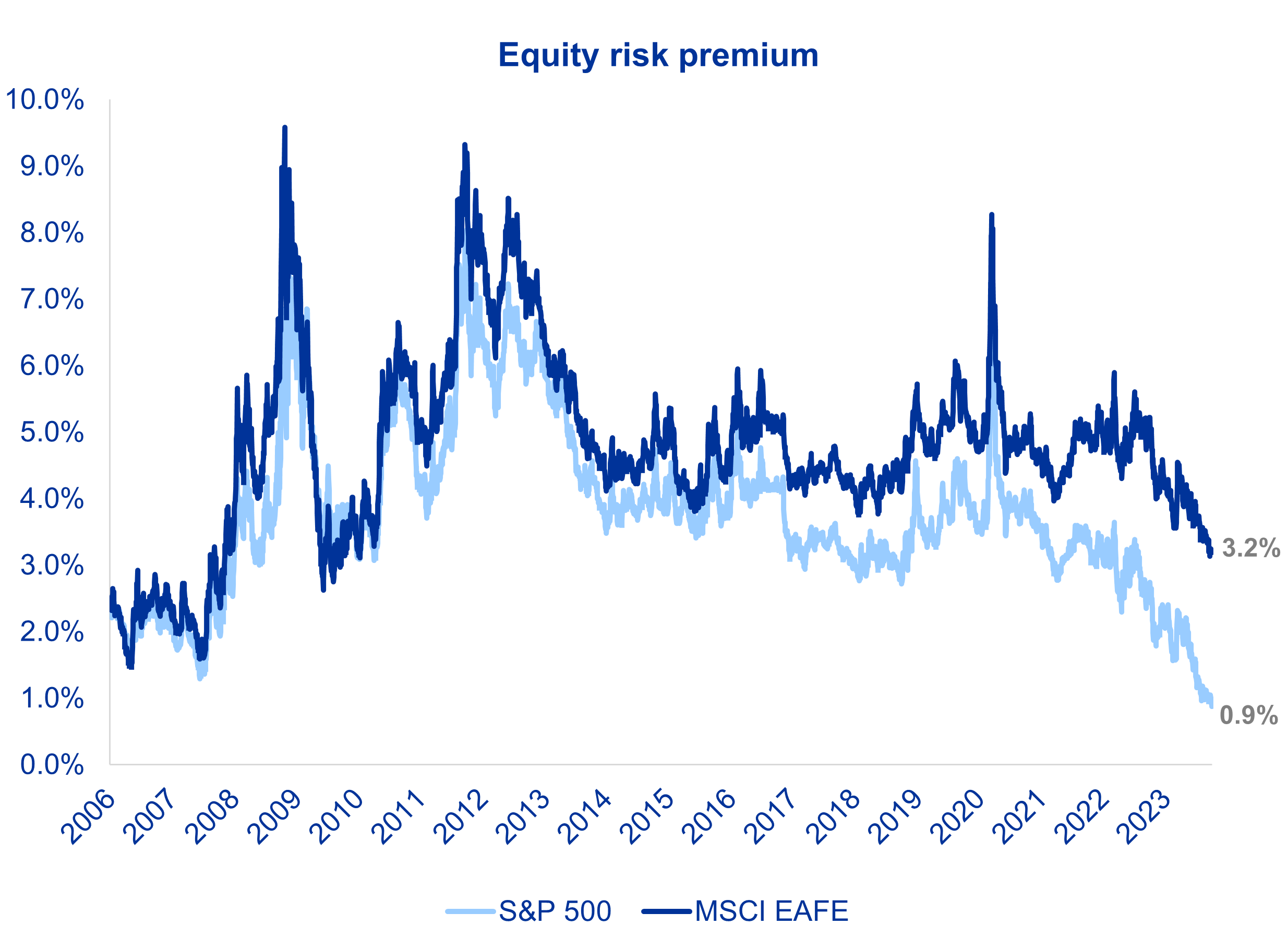

US government bond yields are an important yardstick for pricing financial assets. Warren Buffett said that “interest rates are to asset prices what gravity is to the apple”. The relationship between US government bonds and equities is a simple one: anyone can buy a US government bond and receive a ‘safe’ 4.7% over 10 years, hence riskier assets like equities need to deliver a higher prospective return. This incremental return is known as the “equity risk premium”. In general, the higher the premium, the more attractive stocks will be (and vice versa).

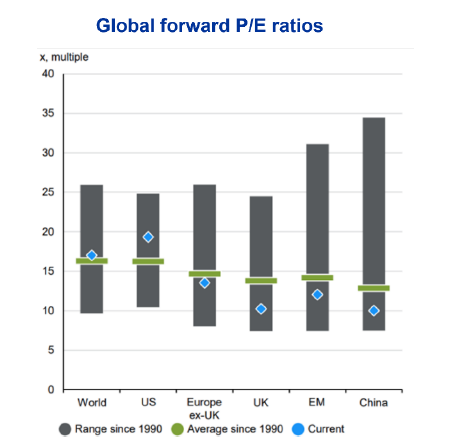

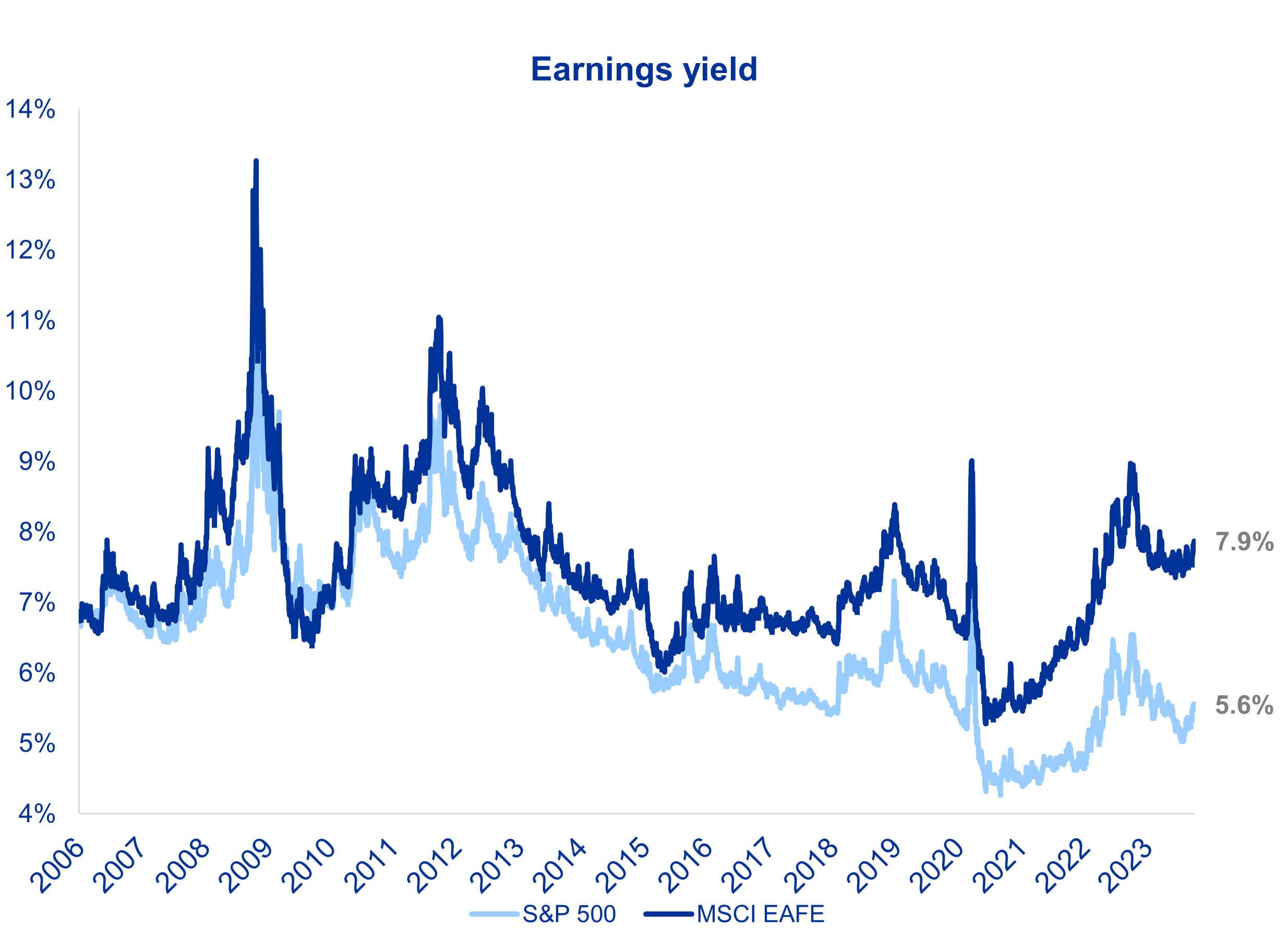

A rough-and-ready measure for the prospective return on equities is the inverse of their price-to-earnings (P/E) multiple, the so-called earnings yield. On that measure the S&P 500 yields 5.6% (i.e. trading on P/E multiple of 18x) while developed markets outside North America are yielding 7.9% (i.e. trading on P/E multiple of below 13x).

Based on inverse of 12 months forward price-to-earnings ratio

Source: Bloomberg

This suggests that US equities are offering an equity risk premium of just 0.9% over the 10-year US government bond while international equities provide a 3.2% premium. This higher equity risk premium provides a larger margin of safety.

Calculated as 12 months forward earnings yield, less yield on 10-year US treasuries

Source: Bloomberg

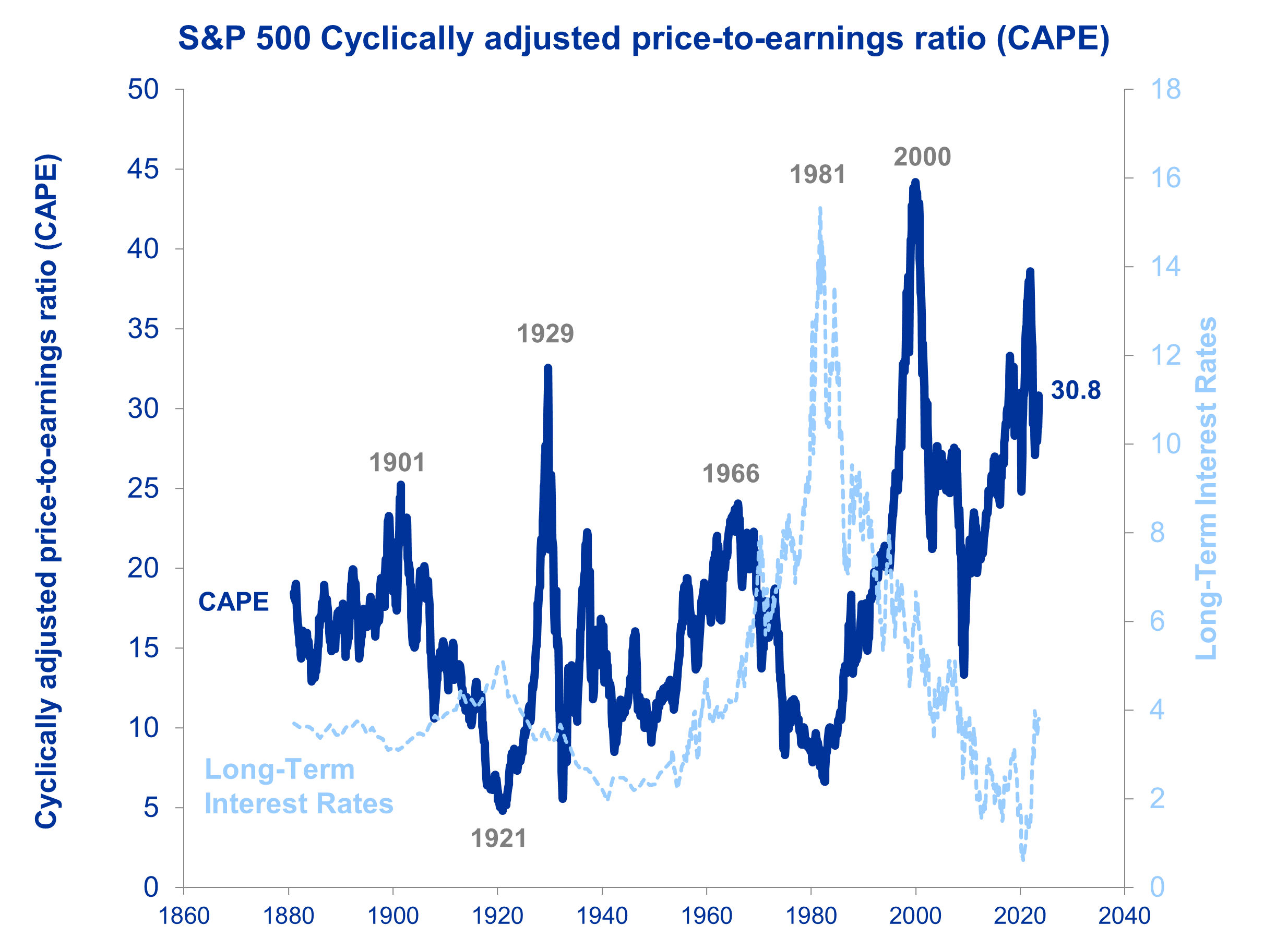

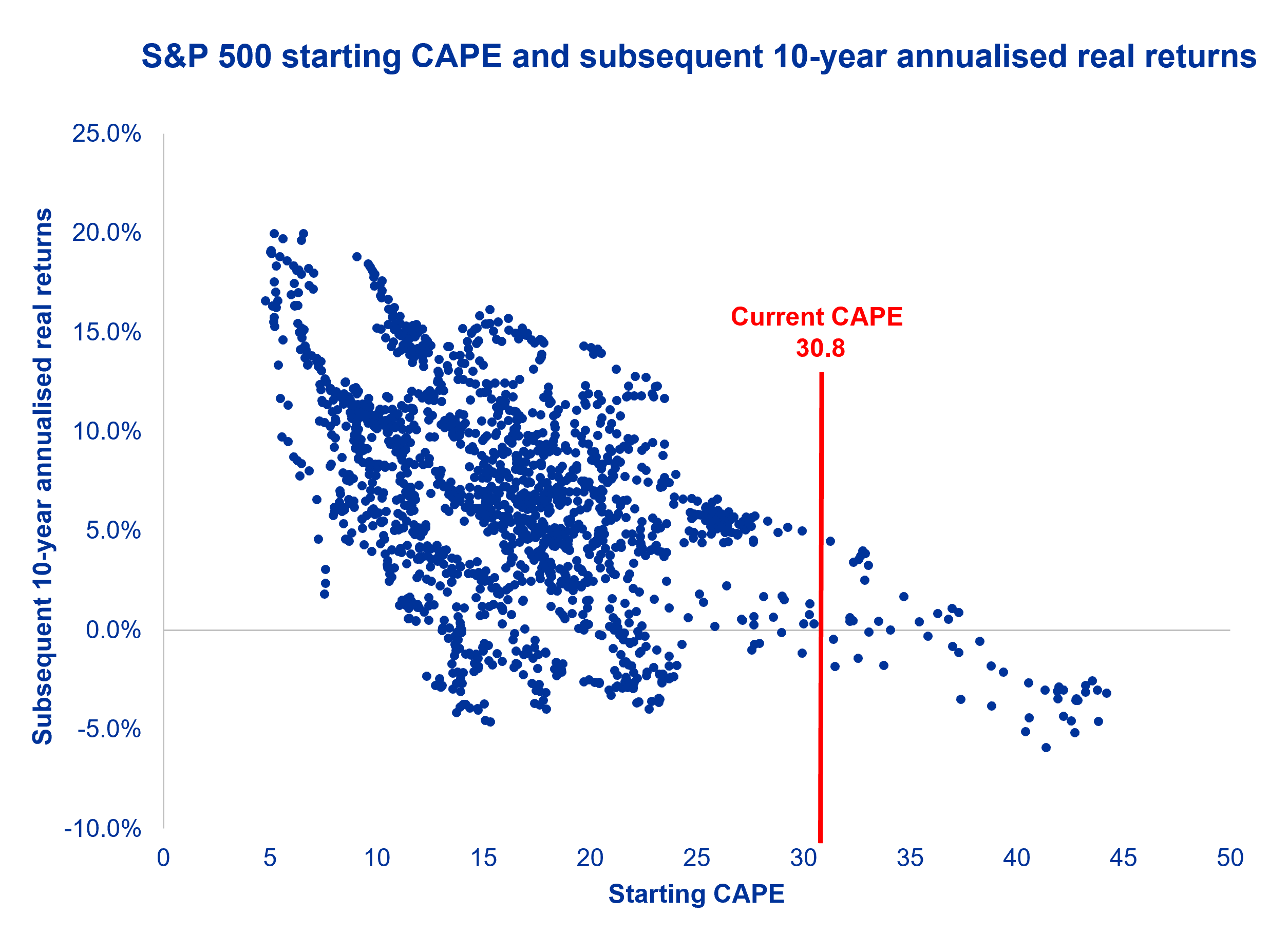

We last saw such low levels in the US equity risk premium before the outbreak of the Great Financial Crisis, but even then they remained at above 1%. Today, we have reached this point as a result of bond yields rising and the valuation of the S&P 500 remaining almost unchanged. This situation, looking at history as a guide, seems unlikely to persist. In a goldilocks scenario this is resolved by bond yields falling and (or) earnings growing. Investors in the S&P 500 may then receive positive, but probably low returns. We believe a less rosy scenario is more likely given sky-high valuation levels. The chart below shows the cyclically adjusted P/E ratio (“CAPE”) for the S&P 500. CAPE is a measure of price to rolling 10-year earnings.

CAPE based on moving average of historical 10-year real earnings.

Source: Robert Shiller via http://www.econ.yale.edu/~shiller/data.htm

Over periods of 10 years or more, this metric has proven to be a highly predictive indicator. The S&P’s CAPE is currently at 31 times. When CAPE hit such levels in the past, it was followed by 10-year annualised real returns of below 5%. History may not repeat itself, but current valuations in the US market leave little margin for error. Having had a very strong run, we believe US equities in aggregate cannot defy gravity forever and will deliver poor returns from current levels.

CAPE data from 1920 to 2013.

Source: Robert Shiller via http://www.econ.yale.edu/~shiller/data.htm

In our view international value stocks offer attractive upside potential for investors willing to research and risk-assess stocks to ensure they provide a margin of safety. We believe fundamental analysis of intrinsic worth combined with the patience to wait until this value is realised will deliver compelling long-term performance. Now is the time to reconsider international value equities.