The decision last week to lower UK base rates from an already ‘emergency’ rate to an historic low of 0.25% has only worsened the plight of savers in the UK but reflects a global problem. The move will be hard on those that need regular, consistent income from their investments: annuity rates are pitiful and income returns from the traditional safe havens of the global government bond markets are now extraordinarily low. There are over $10 trillion of global government bonds trading at negative yields – suggesting that the hard pressed saver is being asked to pay the government for the privilege of lending to it!

Where on earth does one turn for income in this environment? One solution is to reach for higher yields, adding risk by investing in bonds issued by lower quality borrowers. However, we urge caution about relying entirely on the bond markets for income – we have had an extraordinary multi-year bull run and any turn in the interest rate cycle could have severe consequences for bond-holders. When bond yields are as low as they are now, quite small increases in yield mean large falls in price.

Given this uncertainty, Oldfield Partners are highlighting the income generating ability of equities. Oldfield Partners established The TM Overstone UCITS Equity Income Fund in 2011 for precisely this reason – as a means of obtaining income, increasing from year to year so that the investor has a protection from inflation; and at a time when yields from cash and bonds seemed unattractively low, though even more so now.

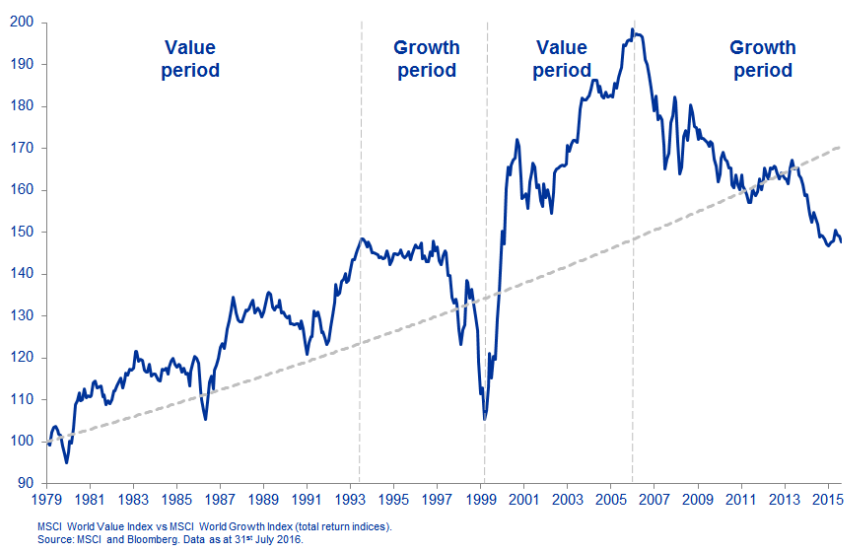

There is nothing very original about an equity income fund, but this fund is different from most other equity income funds on offer. Firstly, and most importantly, this is a value focused equity income fund. Oldfield Partners is a traditional value manager. What does this mean? It means that we believe firmly in the simple proposition, proven by a long history, that stocks with low valuations – in terms of price-earnings, price-cash flow, free cash flow and price compared with assets (‘value’ stocks) tend over the long-term to outperform stocks that are expensive by those measures. Currently, the relationship between value and growth is hugely distorted, with growth having outperformed value for the longest period over the last 37 years (see Chart below). History suggests that the highly stretched ‘elastic’ of value under-performing growth could snap back in a dramatic and rapid fashion.

The fund is run with the same approach as all Oldfield Partners strategies. The portfolio is concentrated (20-30 holdings); we invest without regard to an index; we are contrarian in our thinking, always looking for companies that are unloved; and we invest for the long term. Investing in companies that are cheap and out of favour can be challenging and sometimes uncomfortable as we take differing positions from the herd. But by rigorously sticking to our knitting we are confident that this approach will lead to long term out-performance.

The second respect in which this fund is in a minority is that it invests globally, greatly increasing the opportunity set of potential ideas. We are always looking for the right combination of value, diversification and dividend sustainability, growth and yield at the portfolio level. We see no reason why investors wanting income should limit themselves to their home market. As to currency risk, there are two schools of thought, and we now allow OP Oldfield Partners room for both: the first is that international equity investors want and get currency diversification as a natural consequence of the variety of currency exposures in a global portfolio of companies; the second is that an investor may want to be protected from the risk that in a period when the US dollar or sterling is especially strong investment returns from a global portfolio, in US dollar or sterling terms, may be painfully reduced. We cater to both these approaches among investors by offering a US dollar hedged and a sterling hedged version of the fund and a version without hedging.

Elastic does not stretch forever and at some point, perhaps soon, we will see the reversal of the underperformance of value compared with growth. And The TM Overstone UCITS Equity Income Fund offers investors a decent level of income (currently 3.9% dividend yield) while we wait patiently for this to happen.

Value vs growth