In the past, semiconductor names have been relative wall flowers when compared to their far more public-facing downstream tech peers. These firms have been viewed as ‘pick-and-shovel’ plays to the more glamorous gold rush in online and software activity. This however has now changed. Supply chain issues during COVID brought attention to just how critical these businesses are to global economic activity, moreover their sudden ascent as a geopolitically important industry has shone a spotlight on their operating activity.

Defining the semiconductor industry

Semiconductor chips – otherwise known as microchips or integrated circuits – are the building blocks of any electronic device. From the light switch to supercomputer, they have been the single most influential advancement of a generation. Semiconductors however is a broad term that requires unpacking. It can first be broken down between analogue chips - which sends signals of varying frequency; and digital chips - which use binary communication, such as ON or OFF. On a relative basis, analogue chips are cheap and simple to manufacturer, making them ideal devices to act as sensors of real-world phenomena such as pressure, temperature, speed and electrical power. Analogue production has been a space dominated primarily by US firms, including Texas Instruments, Analogue Devices and Skywork Solutions. Digital meanwhile, allows for extrapolation and manipulation, in order that data can be transmitted. Digital has therefore been central to the development of computing.

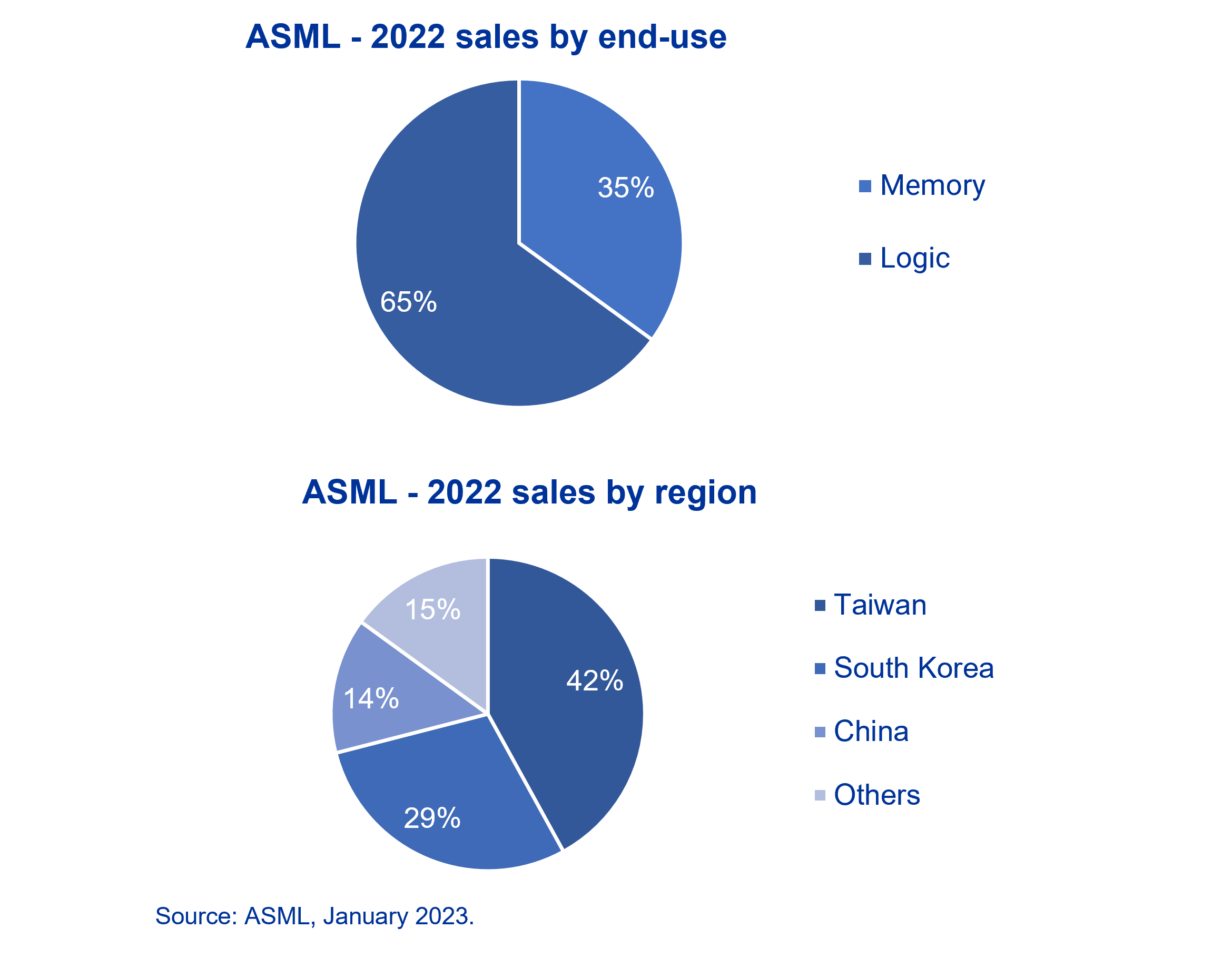

Digital can further be defined between logic and memory. Within this breakdown, logic chips are namely for processing data, a field that stretches from the design companies such as AMD, Nvidia and Qualcomm, to the largely Taiwan-domiciled foundries actually producing the chips such as market leader Taiwan Semiconductor Manufacturing Company (TSMC). Memory chips are different - they are information storage devices, the market is more commoditised, and production is a field lead by an oligopoly of specialised manufacturers – Korean firms Samsung and Hynix, plus US firm Micron Technology. In the case of both high-performance logic and memory, the engineering challenges overcome to make these devices increasingly cost effective and efficient, has been amongst the most remarkable human achievements of our time.

The memory market - Investor challenges

For investors, the memory market has been characterised by extreme periods of greed and fear, this has created considerable volatility, but also opportunity. While structural growth over-time is clearly evident, near-term predictions have proven consistently flawed. To quote John Kenneth Galbraith, the American economist: “We have two classes of forecasters: Those who don’t know – and those who don’t know they don’t know.”

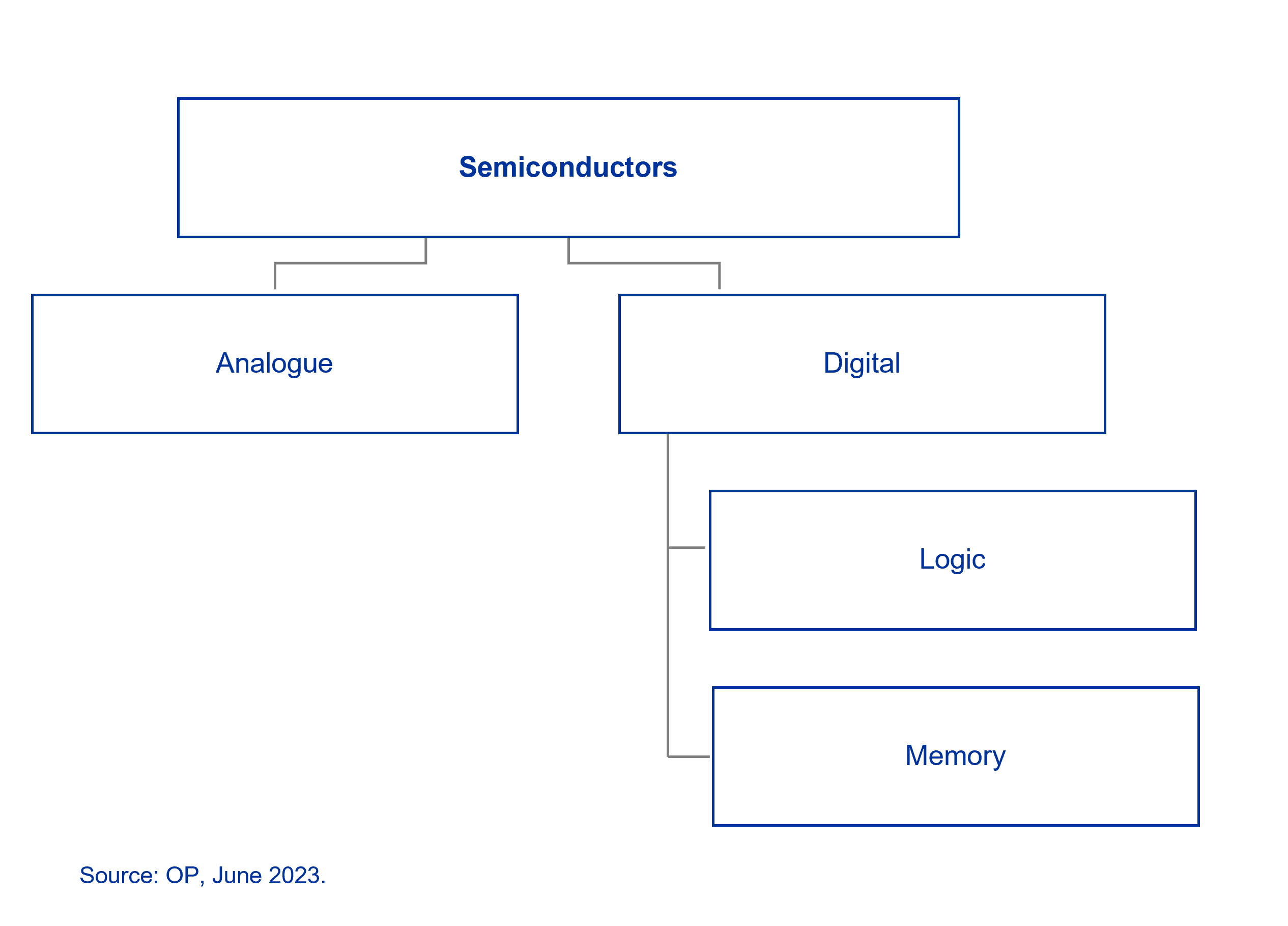

So, to focus on what we know rather than speculate on what we don’t, there are two key truisms which have been historically evident – first, in the past when industry participants have traded at their current valuation levels, investors have subsequently enjoyed excess returns. The second is that that it has historically been more favourable to invest in the up-cycle than the down-cycle, but that the cycle is notoriously difficult to time. In a period when the profitability of those operating in the memory space has been decimated, and share valuations have slipped from their historic averages, the simple question for investors is therefore – is this cycle different? If it is not, then these remain attractive businesses to be invested in. While the question is simple however, the response is more complex, requiring an understanding of the past to make sense of the future.

Understanding the past to interpret the future

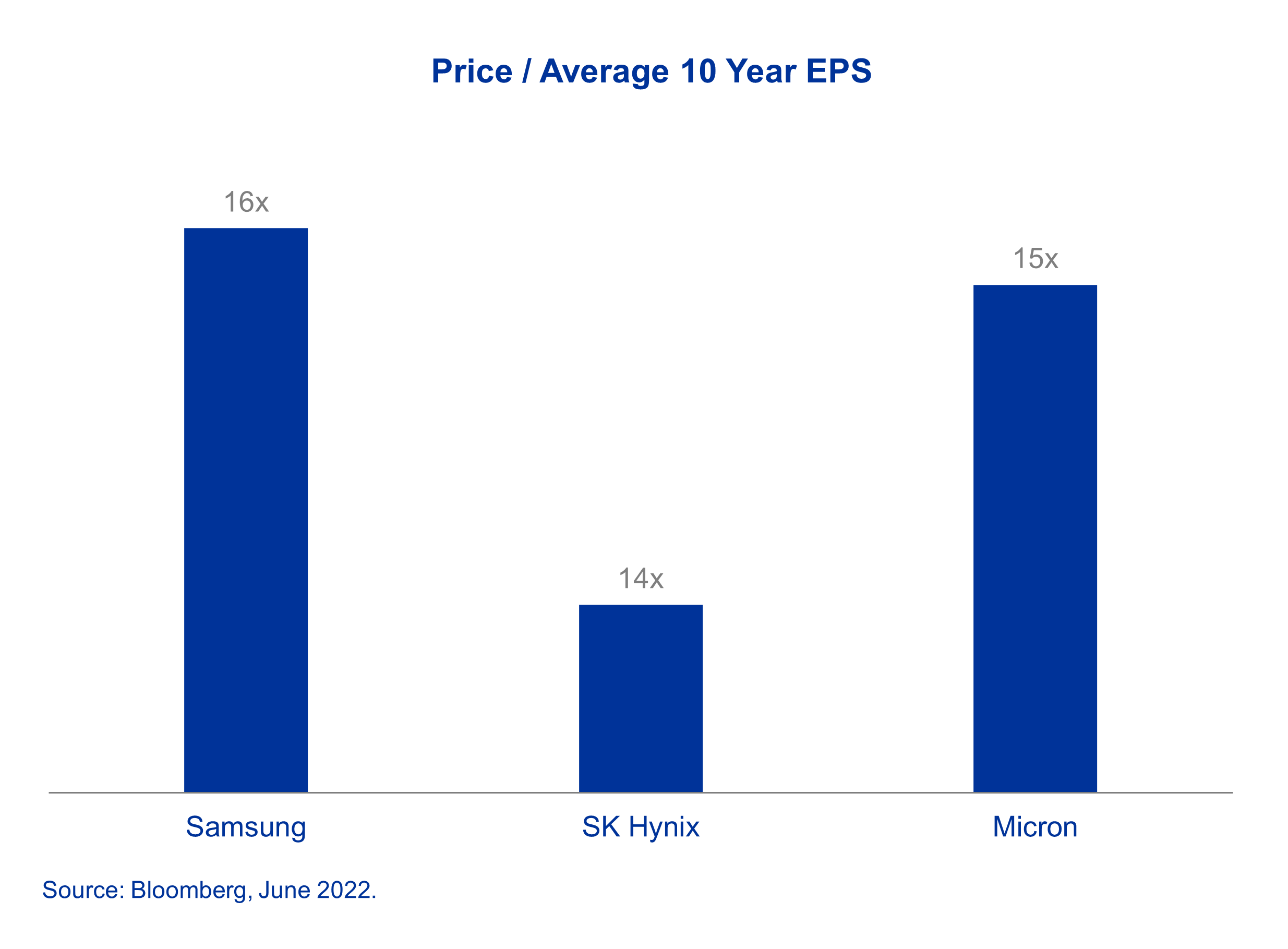

The structural average growth in semiconductor demand has been approximately 7% per annum over the past two decades. This pace is likely to continue going forward, driven not by PC’s or mobile handsets, but by the rise in new application areas such as the automotive, computational (AI), data storage, and wireless telecommunication industries. Long-term forecasts corroborate this – McKinsey for example estimate that the market for semiconductors will grow to $1trn by 2030, a 2021-2030 compound annual growth rate of c.7%. According to the CEO of Micron – Sanjay Mehrotra – memory should grow faster than the overall semiconductor industry.

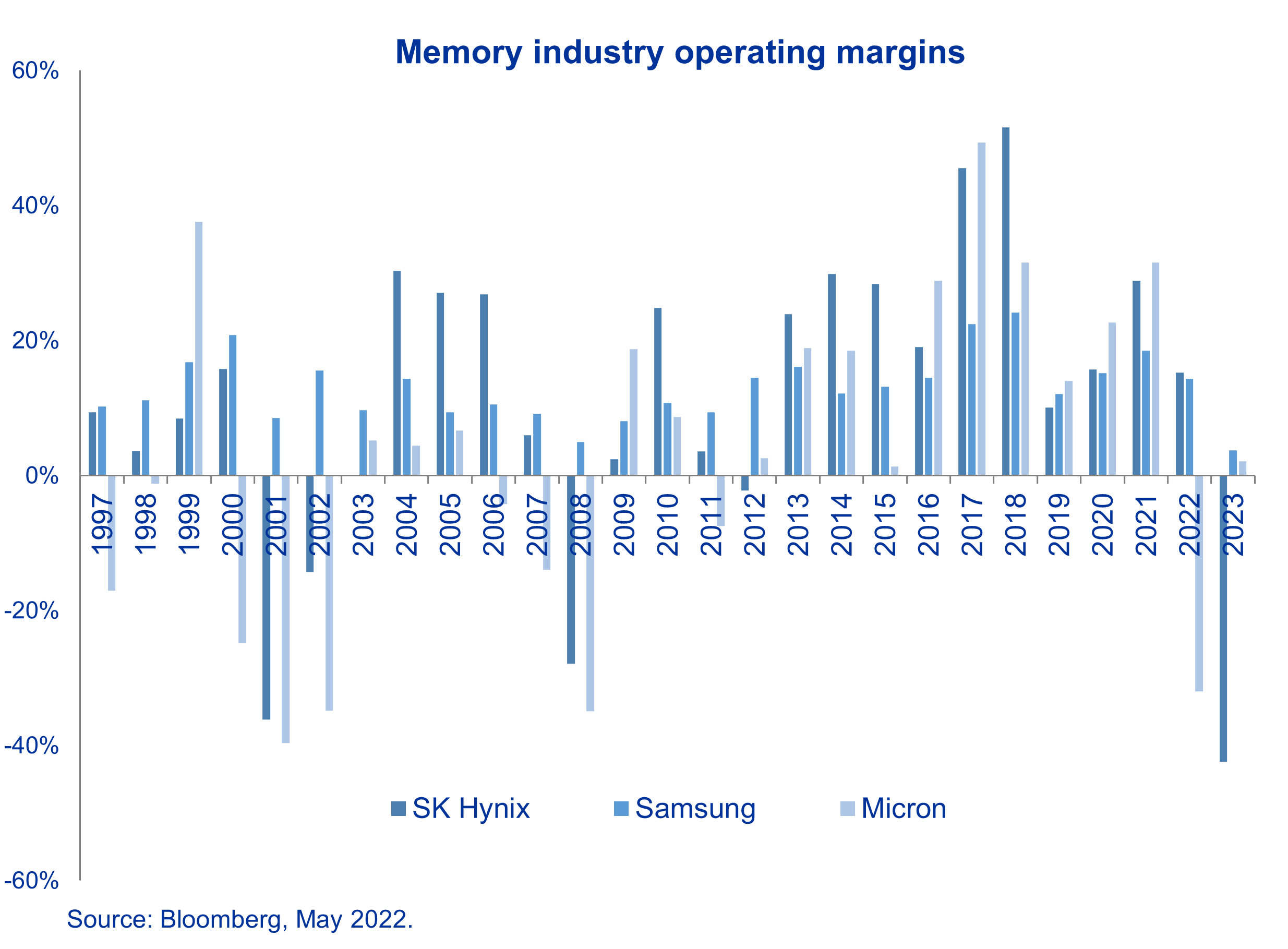

Beneath these headline figures however is a market in turmoil. It had been assumed, that as the market consolidated from 10+ players in the 90’s, to what is a three player oligopoly, the swings of the inventory cycle would become more tame, with trimmed down peaks and troughs. That however changed with COVID. The spike in activity due to COVID-related supply disruptions coupled with a spike in end demand due to changing work habits, created a mega wave across the industry. The animal instincts were back. Margins first spiked up in 2021, then severely slumped in the quarters after. By 1Q23, all three memory firms were showing losses from their memory business. Even Samsung, a firm that had not suffered a divisional loss from its semiconductor operations since 2008, dropped into the red for the quarter.

What we know has changed

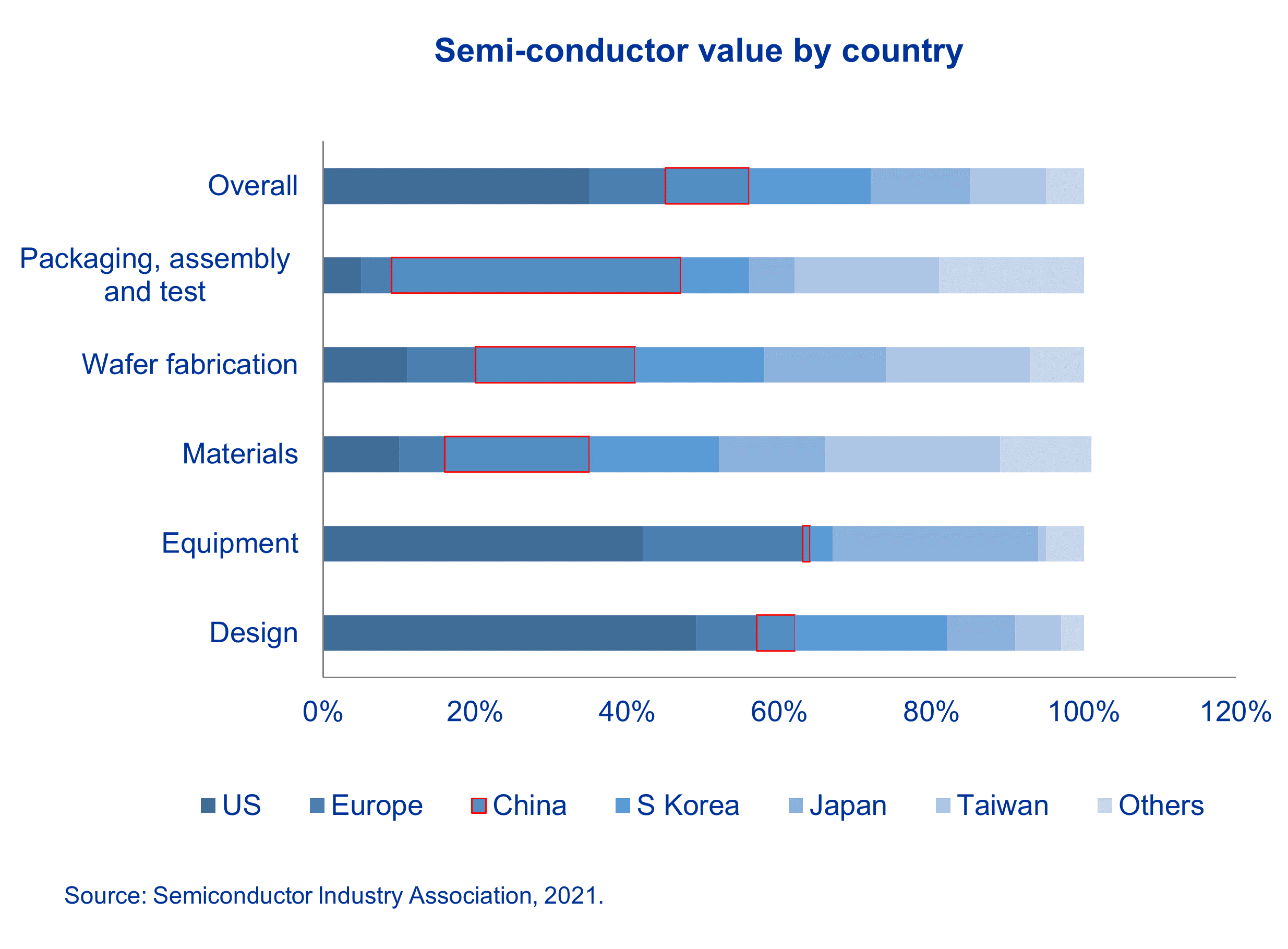

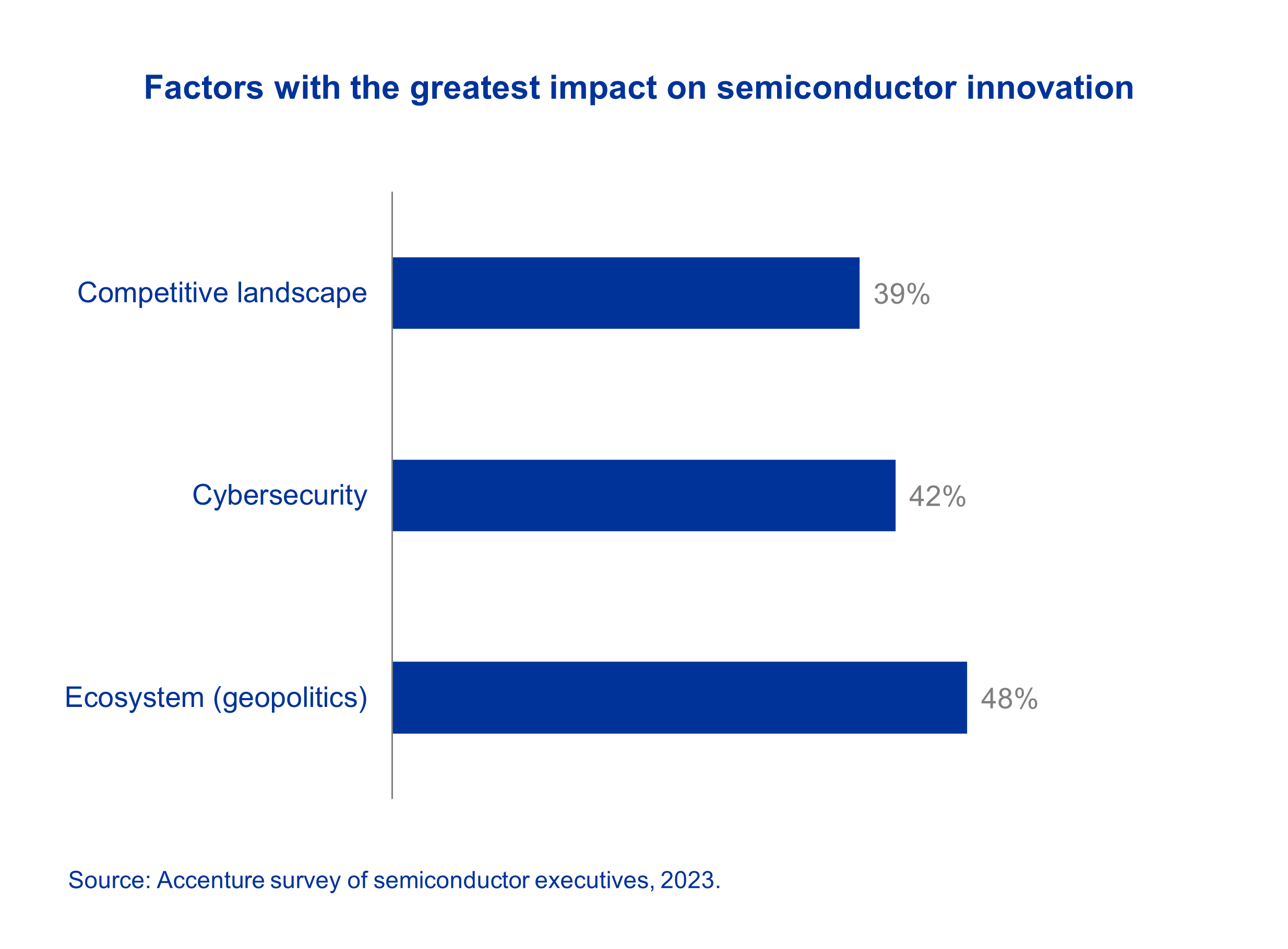

While in many respects the current industry cycle has all the hallmarks of a classic semi-cycle, there is a new variable at work that is shaping capital spending decisions, and therefore the economics of the future. That variable is geopolitics. The US has been through several policy iterations to hobble China’s efforts to nurture a domestic semiconductor industry and develop leading edge technology (AI, 5G etc.), as detailed in the country’s ‘China 2025’ plan. The first policy wave targeted specific Chinese entities such as ZTE and Huawei, restricting these firms from receiving US fabricated chips. This was however ineffective, as most leading-edge semiconductor chips are not fabricated in the US. In a second policy wave, efforts to stunt Chinese development were expanded to include any products which had used US technology in their process, expanding to even include restrictions on US citizens from working with Chinese chip producers. This was a radical step, dramatically pushing back the roadmap for China to develop their semiconductor capabilities.

The restrictions have however not been absolute. US policy makers have been balancing managing ‘China risk’ while appeasing allies and not choking global supply chains. Therefore, Hynix and Samsung have both received exemptions which enable them to bring new equipment and chip components to factories in China, despite the restrictions. It is an unknown how long these exemptions will continue. For Hynix, approximately 25% of their overall memory capacity is in mainland China, for Samsung its less than 10%. What is known, is that if the exemption lapses, then leading edge capacity will likely be shifted from mainland China to Korea, and existing Chinese capacity will be focused on legacy technology. Fortunately, there are a number of players that focus on ongoing legacy nodes, and therefore we know what the economics looks like for this form of capacity. It is therefore our view that there would be value reduction, but not destruction for China-based operations. The degree that this will however effect firms operating in China, will be based on the extent that the US decides to ‘de-risk’ versus an outright ‘de-coupling’.

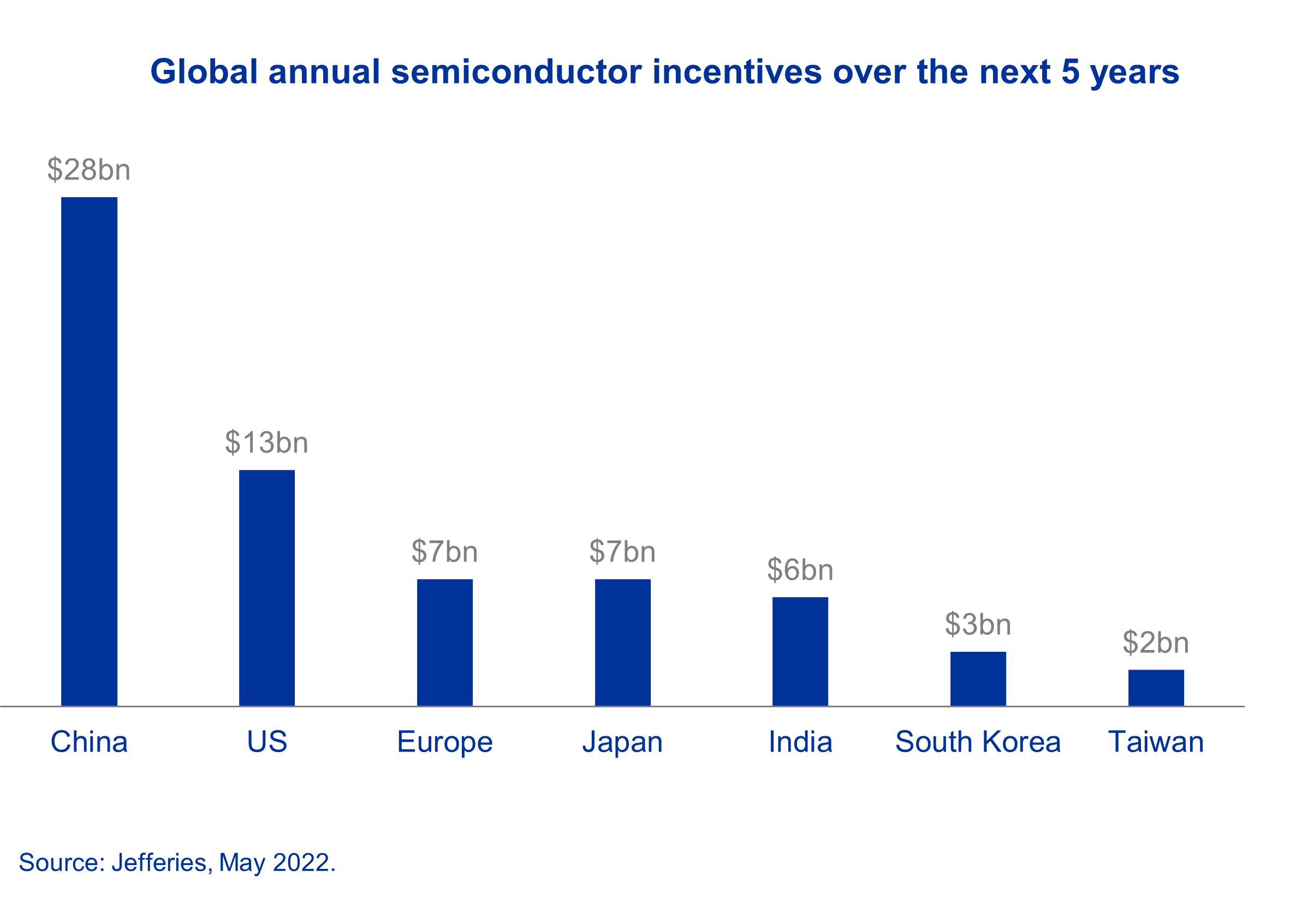

Over the longer-term, it is likely that there will be ongoing near-shoring or friend-shoring of production, and supply-chain will bifurcate in a multi-polar world. Another ‘known’ that will shape the future is the extent that subsidies will play a role in capital allocation. Investment bank Jefferies estimate that a total of $300bn in subsidies have been announced globally, or around $66bn annually over the next 4.5 years. Within that annual figure, the US – offering both stick and carrot – accounts for approximately $13bn per year, while China – desperate to keep the dream of a leading edge semiconductor industry alive – has planned subsidies of $28bn per year. These are vast sums, even for large economies, and reflect the extent that the industry has become a lynchpin of not just supply-chains, but also geopolitics. These geopolitical fault-lines are only likely to expand during the course of the next 18 months, as the US enters its presidential cycle.

What should not be overlooked when thinking about the future

Nokia, Sony-Ericsson, Yahoo, AOL – technology firms that have not just disrupted, but also been disrupted. Value-investors – such as Oldfield Partners - largely focus on technology firms with substantive tangible operating assets, and long track-records. In the memory space for example, the spring chick of the industry has been Korean operator SK Hynix, a firm in operation for 40 years. This has given investors a rich history to analyse what is ‘value’.

Disruption from technology should nonetheless not be overlooked. In the late 1960’s Gordon Moore forecast that the number of transistors in a chipset would double every 2yrs. Gordon would later go on to co-found Intel, and his observation become known as ‘Moore’s Law’. While it is not a law of physics, it has proven quite remarkable in its historic consistency over time. However, one possible ‘unknown’, is what happens if Moore’s law becomes less applicable or entirely redundant. That is, technology advancements reach a bottleneck and the industry matures. This has been a question researched at great length, with highly credible voices on either side of the debate.

First, what we do know – the benefits of innovation have been becoming incrementally smaller. Shrink within memory chips has become increasingly difficult, and ever more costly. Chris Miller makes the observation in his book Chip Wars, that a new fab now costs twice as much as an aircraft carrier and is only regarded leading edge for a couple of years. To give an idea of scale, the leading semiconductor tooling firm globally – Dutch firm ASML – has a market cap of c.$290bn, and its extreme ultra violet lithography machines sell for $100m each. These machines have taken billions in capital to develop, and are so complex that the laser alone has over 450 thousand parts.

In terms of the unknown – the question here is will Moore’s Law become obsolete, and what would be the ramifications if that happens. For the first question, there are a wide range of views. Notably however, Moore’s Law has many times in the past been wrongly questioned. Indeed, Moore himself in the early 2000’s noted that it would bump against limits in a decade or so. Those believers in the continuation of Moore’s Law, such as Jim Keller – one of most highly regarded figures in the industry – cite that there is a roadmap to increase density by a further 50x through such innovations as making the transistors tubular. In fact, there are an array of other alternatives touching on both materials (graphene etc.), and architecture (neuromorphic chips, and molecular engineering) that might advance semi-conductor shrink further. The question of further shrink therefore remains an open question, but a reasonable base case would be that there is approximately a decade of meaningful innovation ahead, albeit with reducing marginal innovation benefits.

Should the industry mature however, there is precedence to understand the trajectory for returns. Two things will likely happen. First, industry participants will likely go through a period of high cash flow generation. Reduced research and capital investment commitments will make these businesses incrementally more profitable. The second stage will be that in the medium to longer-term, the lack of leading edge ‘know how’ will attract new entrants, increase competition, and ultimately reduce margins. While this is likely an end-game for the market, based on current research, it is almost certainly only a longer-term risk, albeit with potential medium-term valuation ramifications.

Back to basics

So, is this cycle different? The short answer is no, this cycle is not that different to past ones. To paraphrase Mark Twain, history may not repeat, but it does rhyme. However, the recent introduction of geopolitics into the industry will likely play a material part in shaping industry economics for years to come, plus incremental technology advancement will create both risks and opportunities for the sector.

Against this backdrop, the funds exposure is primarily to a firm with a cash rich balance sheet, a legacy of leading industry development and very limited direct exposure to China. While there are risks, at the current valuation the return profile is asymmetric, with material upside potential beyond the base case should profitability recover to attractive levels. Indeed, it is our view that while industry players may all well be executing on some of the most complex manmade processes, the forces that shape and drive actual shareholder returns remain remarkably simple, and it is on this that the valuation should be anchored.