Taiwan Elections

Taiwan may be a small landmass, but it packs a big geopolitical punch. Long a thorn in the side of US-Chinese relations, this island of 22 million has positioned itself as a lynchpin within several key global supply chains, most notably dominating semiconductor chip production. These chips are critical, whether you are developing a supercomputer or manufacturing a toaster, nearly every electronic device requires one. At the high-end in particular, where machines etch, deposit and measure layers of materials only a few atoms thick, Taiwan enjoys nearly monopolistic positioning. The island is also situated along a vital trading route – the Taiwan Strait – where an estimated 88% of the world’s largest ships pass through, a global logistics choke point. These factors have combined to make Taiwan a minor, but critical cog within the global economy.

It is against this backdrop that Taiwan held elections on Saturday. Politically, power historically has largely been held by two major parties – the Kuomintang (KMT) and Democratic Progressive Party (DPP). The key distinction between the two being that the KMT seeks warmer relations with mainland China, while the DPP has sought to emphasise independence. The historic context for this difference being that it was the KMT which fled from mainland China when Mao Zedong’s communist army took control in 1949.

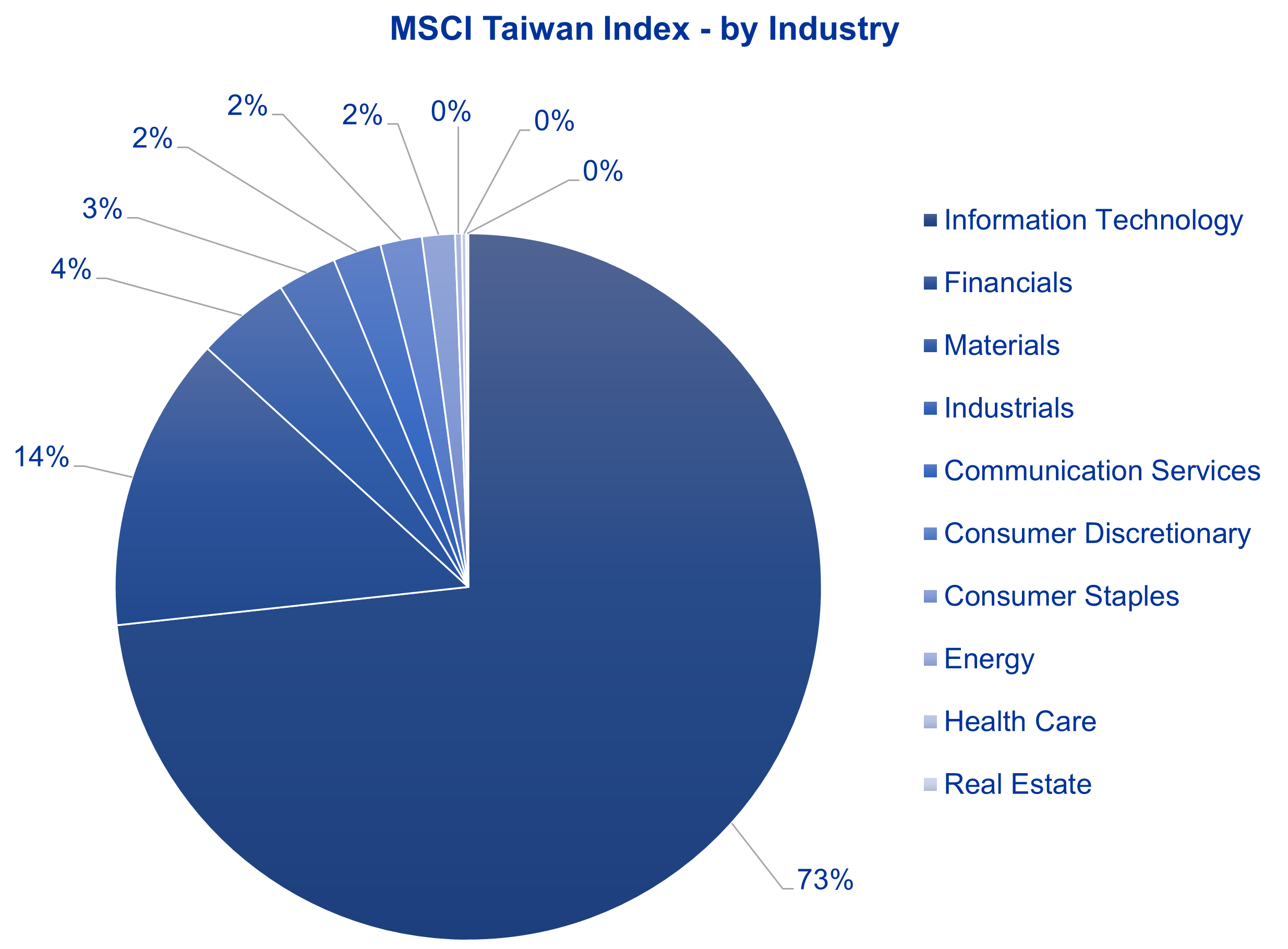

The DPP win announced on Saturday is effectively a continuity vote, gifting the DPP a third term in power, an outcome in line with polling expectations. DPP leader Lai however only won little over 40% of the vote, a dramatic drop from the DPP’s 2020 win when his predecessor achieved a 57% win. This will weaken the DPP’s mandate to effect change. In practice, at a singularly objective level, a KMT victory would have been a preferable outcome for the equity market. China-Taiwan tensions remain the overwhelming risk for many investors, and a thawing of relations with China, would have reduced this concern. Fundamentally though, the Taiwanese equity market is largely comprised of technology firms exporting abroad, with limited exposure to domestic activity, and as such the elections effect on underlying operations more limited.

Source: MSCI. Date: 29th December 2023

The Oldfield Partners Emerging Market Fund currently has one position in Taiwan, although there are several other companies that we continue to monitor. As always, we seek a good valuation, not simply a good company. At a high-level, firms based in Taiwan are typically well-governed, and have generous dividend payout policies; the downside is often that there are competitive, but lagging-edge, mainland Chinese firms snapping at their heels. The fund's position is ASE Holdings (‘ASE’), the global leader in semiconductor packaging and testing. Founded by the Chang brothers, the firm has been established for over four decades, and evidenced a good growth track record since listing. It is highly interconnected with the semiconductor supply chain, but unlike the foundries has a lower level of technological transition risk, albeit still a consideration. The firm trades at a 5% forward dividend yield, which given the scope for sustained growth from structurally rising semiconductor demand, is a highly favourable valuation compared to peers.

2024 is a big year for Emerging Markets. Asian broker CLSA estimates that in 2024 over half of emerging market countries will have an election when calculated by MSCI EM index weight. That is an extraordinary proportion when one considers that approximately one-third of EM has not got a democratic voting process. At the fund level, bottom-up valuation analysis drives our investment conclusions, albeit while not overlooking the risks and opportunities that arise due to country variance. We remain comfortable that on this basis, Emerging Markets have some of the most attractive opportunities of any asset class.