Indonesia Election

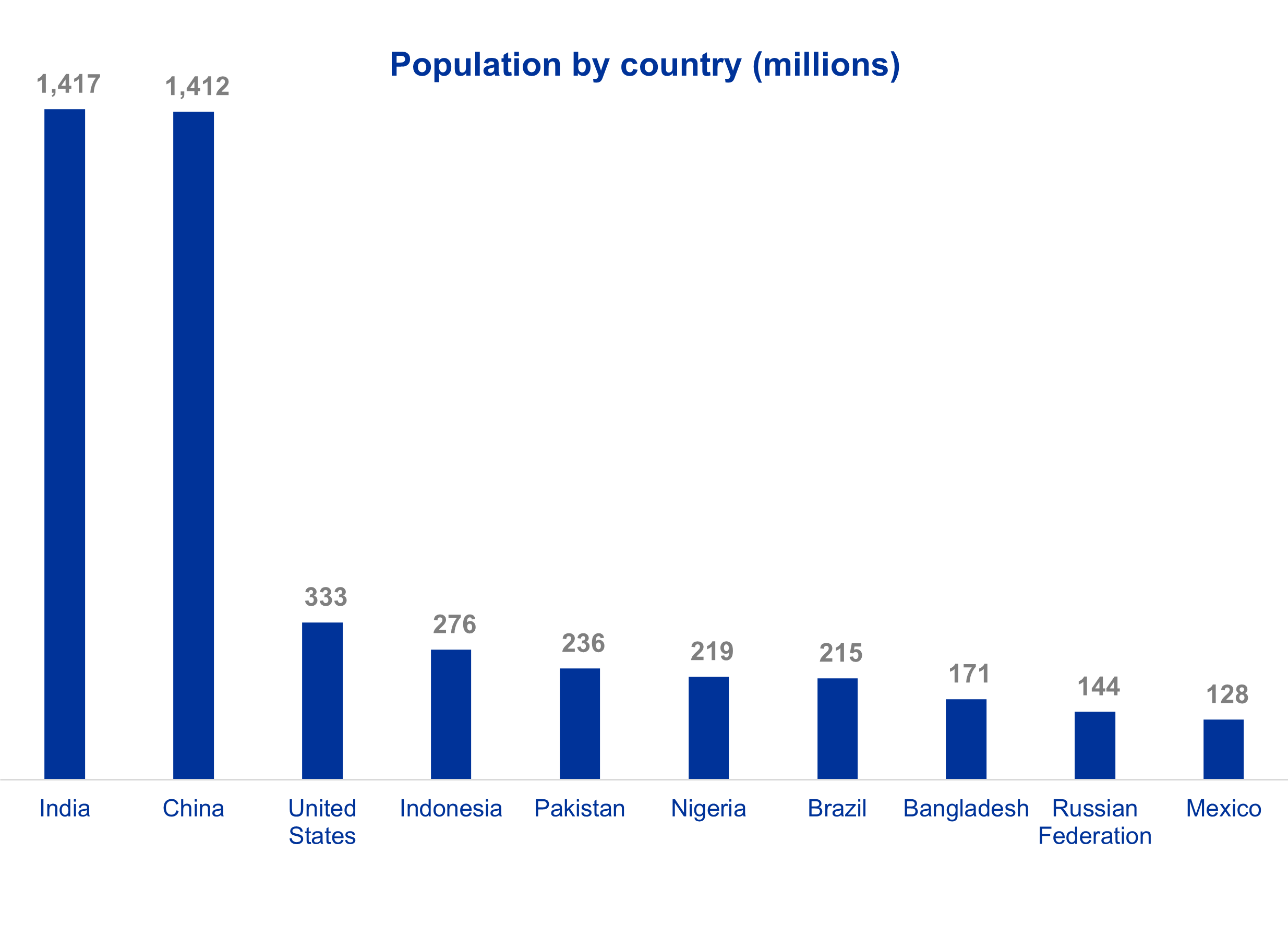

Be it backpacking in Bali or surfing in Sumatra, Indonesia has built a reputation as a travel mecca for the young and active. There is however so much more to this vast country than tourism. With a population of 276m, it is the largest Islamic nation globally, its 6,000 inhabited islands spanning a distance equivalent to one-eighth the Earth's circumference. While it remains omitted from the famed ‘BRICS’ acronym for key emerging markets (Brazil, Russia, India, China and South Africa), this looks increasingly misplaced as it rises in economic clout and regional importance.

Source: World Bank, 2022

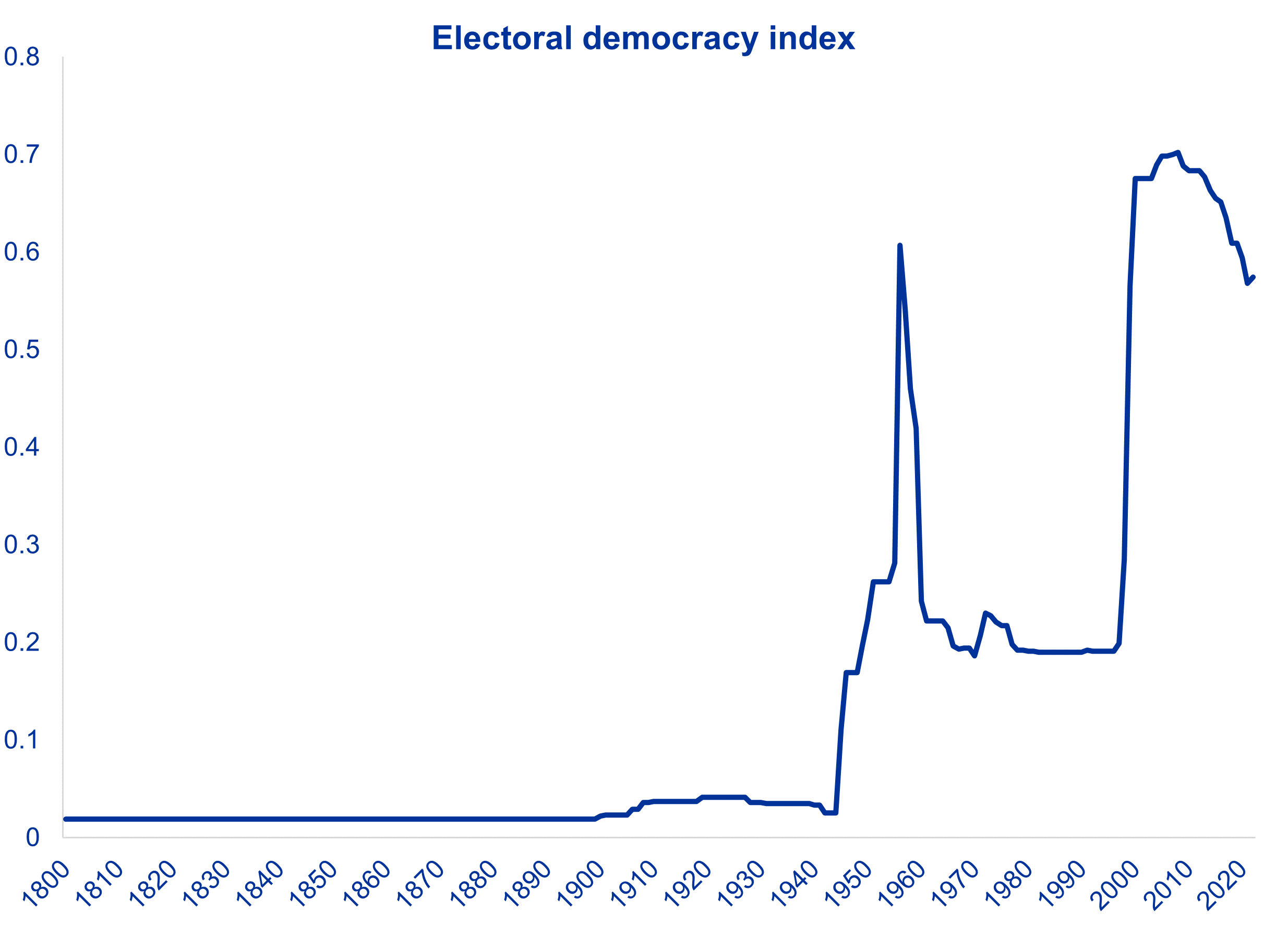

It is however an emerging market with a more tumultuous history than most. Formerly known as the Dutch East Indies, it claimed independence after the second world war in 1945. This was followed by a period of great uncertainty, including the military dictatorship under General Suharto across much of the 60s and 70s, then the devasting East Asian Financial Crisis of the late 90s. Since then, the country has however entered a period of relative prosperity, with living standards rising off a low base, the gradual emergence of a middle-class, and a substantive rise in democratic freedoms.

Source: OurWorldInData, 2023.

It is against this backdrop that Indonesia held an election on Wednesday (February 14th). The vote pitted Prabowa Subianto, a 77 year old former general, against Anies Baswedan, a 54 year old academic and former governor of Jakarta. Prabowa represented the continuity candidate, so much so that he had the former President’s son as his running mate. The sample ballots strongly suggest a majority win for Prabowa, an outcome that mitigates the need for a second round of voting. While he cuts a controversial figure, including allegations of torture during the 1990’s, this is a strong result for the since reformed statesman.

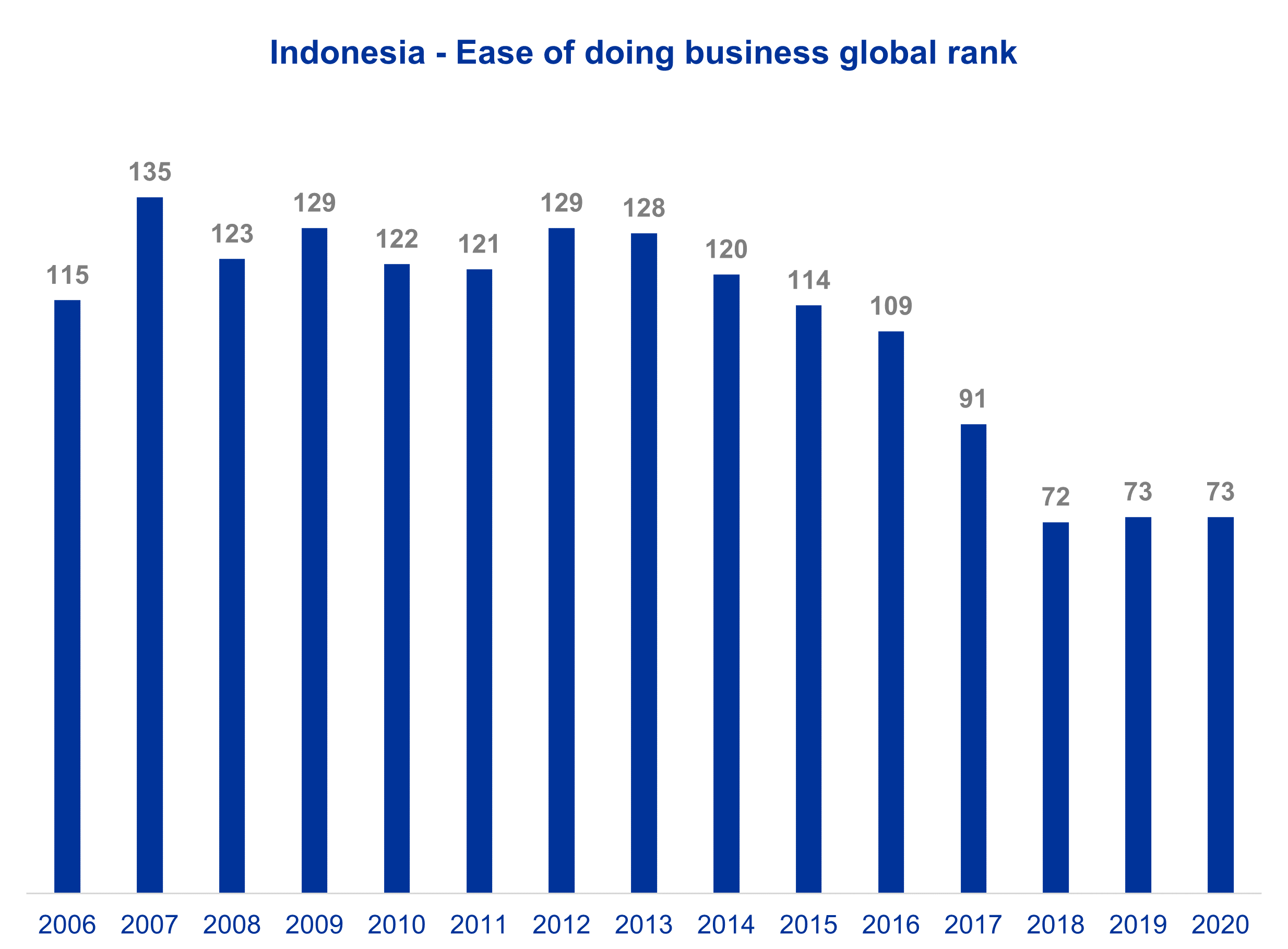

For equity markets, the election outcome means a likely continuance of the Jokowi Presidency development agenda. Jokowi was widely liked by investors and voters, so this result is largely positive. When he was elected in 2014 he was Indonesia’s poster boy, known as “Indonesia’s Obama”, with Time Magazine pasting him on the front page under the banner “A New Hope”. Plenty of the shine has since come off since then, but he has largely remained popular.

Source: World Bank, 2020.

The Emerging Market and Emerging Market ex-China fund has two direct exposures to Indonesia: Telkom Indonesia and Indofoods. Neither of these are particularly exciting businesses operationally – one is the leading telecom operator, the other the leading noodle brand. They both however have long track records going back multiple decades, have generated persistent structural growth over time, have demonstrated resilience during downturns, and currently trade in the bottom quintile of their respective valuation ranges. The fund also has a holding in First Pacific, an HK domiciled holding company with underlying exposure focused across Philippines and Indonesia, (mostly names listed on the local exchanges). The firm generates a dividend yield in excess of 8%, and trades at a substantive discount to NAV.

We continue to remain confident in the valuation case for positions held in the fund. In the event of an EM rally, some of these positions could very comfortably perform substantially ahead of our base case ‘fair value’ and still be within historic trading ranges. It’s largely been a weak decade for emerging market performance when compared to developed markets (namely US), and while this is disappointing, in our view it has also created some exceptional bottom-up opportunities.