Tragedy & Triumph – The Russian Capital Market

Foreword: We find the level of human suffering from the ongoing war between Russia and Ukraine deeply saddening. We seek however to be entirely transparent and honest about the situation, a freedom we are fortunate to enjoy as an independent specialist manager. To be clear however, comments in the below relate only to the OP Emerging Market Funds, where there is one holding held at nil value (zero).

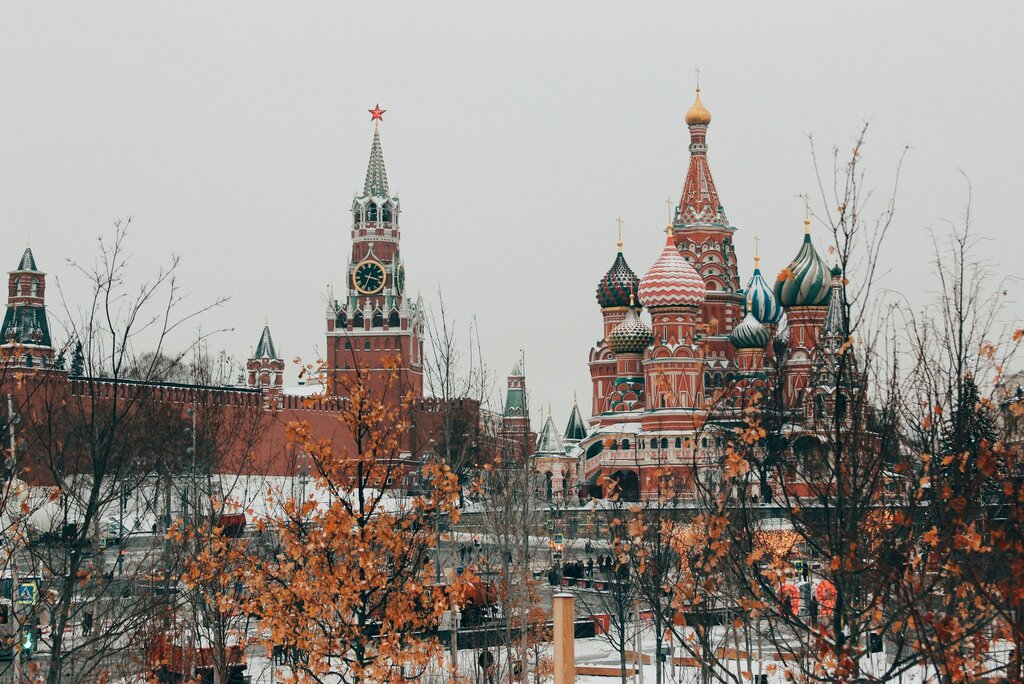

“Russia is a riddle wrapped in a mystery inside an enigma” Winston Churchill famously quipped. There was however no mystery to Russia’s recent election, with opposition exiled, jailed or dead, the process had all the suspense of watching custard curdle. While elections in Russia may be but a fig leaf over the Putin autocracy, they do however offer an intriguing insight into the personalities and policies currently at play.

Within Russia, underneath the political bravado and sabre rattling, is an economy chugging along, and a stock market not just actively trading, but actually doing quite well. Life in Russia has no doubt been greatly inconvenienced, but the disruption is far less dramatic than one might expect for a country both in outright war and largely ostracised from global markets.

Superpower with a small ‘s’

Putin has now effectively been in power for 24 years, not quite equal to Stalin’s tenure at the top, but enough to make him critical in the shaping of modern Russia. He is still broadly popular domestically, and the conflict with Ukraine has only sharpened the resolve of that support.

The country has a rich history and, from Ivan the Terrible through to the fall of the Berlin Wall, has been often found at the centre of geopolitical change. Currently within the global economy, Russia now only has a GDP roughly half that of California’s, and as such its direct economic clout is relatively negligible. Spanning 11 time zones however, it is a colossal land mass bordering 14 countries, blessed with considerable natural resources, and with a proclivity for expansionism - all of which combine to give it an ongoing outsized influence on the world stage.

Dour but rising economy, thriving equity market

Russia’s economic situation has weakened; however, the country is down, not out. After a 1.2% fall in 2022, the economy generated 3.6% GDP growth in 2023, and the IMF forecasts that it will continue to grow in 2024. There are a couple of moving parts here though – most notably that within these figures there is an almost doubling of ‘defence’ spending that has pushed the military industrial complex to capacity. In addition, while Russia may be enjoying growth, it has also had to borrow to finance the war with Ukraine, a feature that may constrain future growth.

As for the equity market, this has not just demonstrated resilience, but prospered. Over the last five years, the total USD MOEX index return has been 36%, performing three-times ahead of the MSCI EM index return of 12%, (the 10yr and 3yr figures are likewise ahead). This namely reflects the extent that commodity firms dominate the domestic equity market, and that these businesses have profited as commodity prices rise – a phenomena in part due to western sanctions limiting Russian supply. The frustrating irony that Russian companies are net-net benefiting from the very sanctions targeted to hurt them will not be lost on western diplomats, but a solution to cut this particular Gordian knot still remains elusive.

One of the better performers, one of the biggest detractors

The Oldfield Partners Emerging Market Fund has one “holding” in Russia – Lukoil, a low-cost oil and gas producer. The pre-war rationale was that its product was a dollar denominated global commodity less effected by the fortunes of domestic Russia, it had well-aligned management, an excellent balance sheet, a proven track record of returning excess cash to investors, and it could be purchased via an offshore ADR. When acquired, it coupled these company features with a dividend yield considerably ahead of global peers, and the prospect of dividend growth as production increased. Whilst we regret the investment, it was a smaller size position and the risks both known and weighted against the prospective upside. To paraphrase Machiavelli, “it was mistake made of ambition”, “not one of sloth”.

It is cold comfort to note that while it has detracted from fund “performance”, its total return makes it one of the better “performers”. Over 3 years for example, the MSCI EM index is down 17%, Lukoil is up 62%. This distinction is due to the phenomena that while shares in Lukoil actively trade on the Moscow Exchange, sanctions make any trading inaccessible to foreign institutions, thus necessitating that the shares are held at ‘nil value’ (zero) in the fund. The funds holding however remains in custody with dividends accruing, and we continue to seek a legal means of exit.

When (if) the rubber hits the road

All of this will likely remain academic against the current political backdrop. If capital markets in Russia do once more become accessible however, fortunes will likely be made or lost in the subsequent trading frenzy. There will be plenty of unknowns at this point, but it is very likely that the removal of sanctions would only come after a peace deal, at which point both the backdrop and sentiment might be quite different. Nonetheless, some investors will outright remain against investing on ethical grounds, preferring that Russia remain indefinitely banished from global capital markets.

The Oldfield Partners Emerging Market Fund is a value fund, and as such we are used to objectively investing in parts of the market unfavoured by others. As it stands for the names on our Russia watchlist, even if markets became accessible, we would not be buying at current levels. That calculation could change if there was a dramatic downward pressure on prices, plus clear improvement in conditions. It would however require a truly disruptive shift, as while certain Russian names could once more enter our immediate universe, we find considerably more compelling opportunities elsewhere.